The government is on a path to introduce legislation that will enable the Solicitors Regulation Authority to take greater action against the ‘facilitators’ of money laundering; law firms will soon need to brace themselves for unlimited fines from the SRA for ‘economic crimes’.

In the wake of the move by the SRA this summer to increase its powers to fine ‘traditional’ law firms (and the solicitors who work in them) from £2,000 to £25,000, law firm leaders must once again brace themselves for the next tool to be added to the SRA’s armoury: unlimited fines for certain economic crimes.

The Economic Crime and Corporate Transparency Bill, presently at committee stage, introduces a raft of new measures designed to combat economic crime, including the provisions concerning unlimited fines for economic crime. When enacted, the impact on law firms, solicitors and employees facing investigation and enforcement action by the SRA will be profound.

What is proposed

The government is proposing the removal of the statutory cap on the financial penalty that the SRA can direct traditional law firms, solicitors and employees, to pay in disciplinary matters relating to economic crime.

Clause 154 of the bill will amend section 44D of the Solicitors Act 1974 and paragraph 14B of Schedule 2 to the Administration of Justice Act 1985. This will empower the SRA to impose an unlimited financial penalty on an individual or entity it regulates if it finds a failure on the part of that individual or firm that relates to either of the following:

1. the prevention or detection of economic crime; or if

2. the failure consisted of an act or omission which had the effect of inhibiting the prevention or detection of economic crime.

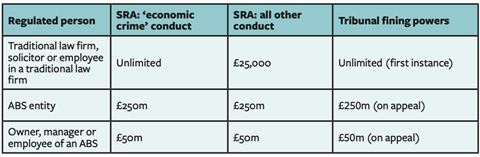

If the provisions are enacted, the SRA financial penalties regime landscape will look like this (see box, top):

Economic crime

The definition of ‘economic crime’ (under clause 153(2)) is wide and consists of an act which:

(a) constitutes an offence listed in Schedule 8 (‘a listed offence’)

(b) constitutes an attempt, conspiracy or incitement to commit a listed offence, or

(c) would constitute a listed offence or an offence specified in paragraph (b) if done in the United Kingdom.

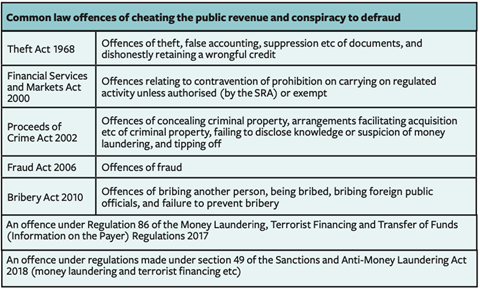

Schedule 8 provides the finite list of offences (the ‘listed offences’), which include those in the box below.

The situations where the SRA will be able apply unlimited fines will be wide-ranging, including where an individual or firm positively acts in failing to detect and prevent economic crime, where they act in such a way that inhibits prevention or detection and also where they fail to act when expected to, and where as a result of that failure, the crime is inhibited from being prevented or detected.

The definition of economic crime as proposed by the bill leaves little uncertainty whether failures relating to anti-money laundering (AML), fraud, and bribery will fall within the remit of the SRA’s new unlimited fining powers, if enacted. What is less clear, though, are the situations where such failures might be considered to amount to theft. For example, will conduct such as transferring money from office to client account or allegations of overcharging clients fall within scope?

The SRA and this new provision

To give effect to the new provision, the SRA may seek to pass associated rules that ‘apply only for the purposes relating to the prevention or detection of economic crime’. Those rules would be the most straightforward gateway into its use of the power, and would be a direct alternative to it needing to prove that the act or omission in fact ‘had the effect of inhibiting the prevention or detection of economic crime’, which will be more factually challenging and might require proving the underlying crime itself. If this analysis if correct, the SRA could have a separate set of rules and bring enforcement action on the back of those.

How the new provision will work

The SRA will be able to impose unlimited fines on individuals, firms and employees where it determines that failures have occurred, either through an act or omission. There may be an underlying conviction for a criminal offence, but there need not be.

The SRA has warned that if its fining powers increase in this way, it ‘will use those fining powers to full extent to make sure that there is compliance in the AML area’. This warning is hardly surprising given the findings of the Spotlight on Corruption report that enforcement action taken by the SRA to date (and by the other legal service regulators) has been ‘uneven and inadequate’.

An unlimited fining power in relation to matters of economic crime will mean the SRA will be able to impose more fines internally without referral to the Solicitors Disciplinary Tribunal. This will reduce the degree of impartiality to which the SRA’s decisions involving large fines are subjected. However, the usual route of appeal to the SDT will still apply under 5.1 and Annex 2 of the SRA Application, Notice, Review, and Appeal Rules.

New regulatory objective: ‘promoting the prevention and detection of economic crime’

The bill also proposes a related clause which introduces a new objective into the Legal Services Act 2007 for the regulation of the legal profession (adding to the present list, which includes protecting and promoting the public interest, and supporting the constitutional principle of the rule of law), namely ‘promoting the prevention and detection of economic crime’. To enable legal services regulators to achieve this new objective: ‘…it is important to ensure that [they] have the right tools to effectively promote compliance within their regulated communities’.

The proposed objective (welcomed by both the Legal Services Board and the SRA, but strongly opposed by the Bar Council and others), would mean that the LSB and the other legal service regulators would have a new workstream of seeking to identify and prevent the involvement of legal professionals in economic crime.

What next?

Once the bill has received royal assent, we can expect the SRA to consult the SDT on the levels of penalty it can set, and on draft rules, which will then require the LSB’s approval. However, there are many gaps to fill in before then.

Julie Norris is a partner in the regulatory team at Kingsley Napley

No comments yet