A worthy successor to Mann’s magnum opus

Mann and Proctor on the Law of Money (eighth edition)

Charles Proctor

£295, Oxford University Press

★★★★★

Nigel Farage, banks and money generally have been in the news recently. Mann and Proctor on the Law of Money is a substantial work running to 850 pages. While it won’t assist Coutts in respect of its current difficulties, it will enable commercial lawyers to navigate the choppy waters of international monetary affairs.

The first edition of this work was published in 1938. The original author, German lawyer FA Mann, based his seminal work, The Legal Aspect of Money, on his doctoral thesis. Mann emigrated from Germany to England, but in 1946 he returned to Berlin as a British member of the legal division of the Allied Control Council, where he worked on the denazification of German law.

Mann died in the midst of correcting the fifth edition. A contemporary review stated that the book must rank as one of the great legal publications of the century in English.

Mann and Proctor on the Law of Money deals with a plethora of topics, including bilateral investment treaties, sanctions law and exchange control issues, as well as the public international law of money.

Some years ago, I was instructed by a Greek client who had deposited a substantial sum in a bank in Ethiopia during the reign of Emperor Haile Selassie. The exchange rate was then two Ethiopian birr to one US dollar. My client’s account was frozen in 1976, following a revolution. More than 40 years later, I was instructed to ‘unblock’ it, by which time the exchange rate was 54 birr to $1.

The Ethiopian government argued that my client had taken a commercial risk when investing in an Ethiopian bank and therefore any adverse exchange rate fluctuations were to be borne by her. The late Judge Crawford of the International Court of Justice advised that the more favourable 1976 exchange rate should apply, as the risk of adverse exchange rate fluctuations passed to the Ethiopian government at the moment it decided to block my client’s bank account.

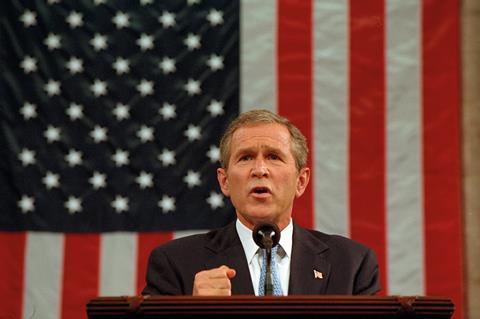

This book deals with many other fascinating topics, including so-called long-arm jurisdiction. Of particular interest are the measures the US took in the aftermath of the attacks on 11 September 2001. Executive Order 13224, which prohibits dealings with persons involved in organisations deemed to be linked to terrorist action, was followed by the USA Patriot Act, sections 317 to 319 of which create long-arm jurisdiction.

Where a person that has been involved in a financial transaction in the US involving unlawful activity commits an offence, he is liable for a penalty up to the value of the money or the asset involved. Section 317 allows the court to exercise long-arm jurisdiction over foreign banks which have no connection with the US other than that they maintain an account with a US financial institution. Section 319 allows for the assets of the foreign bank in the US to be forfeit on the grounds that the funds to be forfeited have been deposited in that foreign bank outside the US.

Thus the US exercises extraterritorial jurisdiction not only over terrorists, but also those within the financial system who do business with them (perhaps unwittingly). Rather alarmingly, foreign banks can now be deprived of their property without due process of law.

Charles Proctor’s analysis and presentation of the subject in both the national and international settings is invaluable. His systematic presentation, analysis and classification of the problems, along with his knowledge and understanding of the same, make this a worthy successor to the previous editions prepared by Mann.

Stephen D Sutton is principal at Suttons Solicitors & International Lawyers, London

1 Reader's comment