Solicitors who can address the financial aspects of their clients’ needs will be one step ahead of competitors who are encroaching on solicitors’ business space. However, not all financial advisers provide a conflict-free service or have the appropriate qualifications and experience to equip them to work with solicitors.

SIFA (Solicitors Impartial Financial Advice) was originally formed by a solicitor in 1992 with the objective of assisting solicitors in providing their client’s with access to financial advice. SIFA launched SIFA Professional in 2009, as a response to the Legal Services Act. It is a membership support proposition designed to equip, educate and support quality impartial advisory firms to work with solicitors.

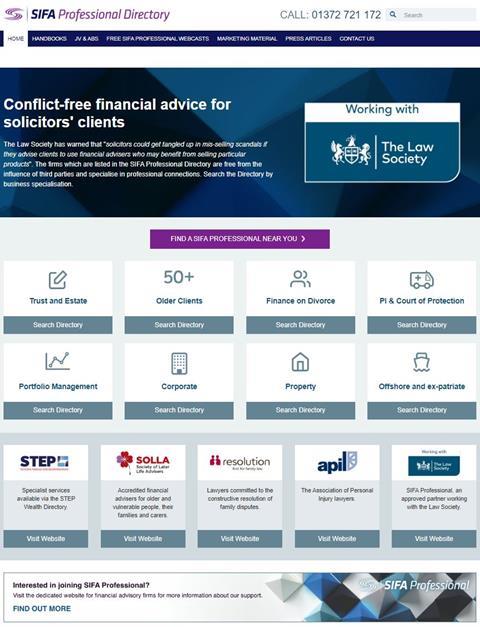

Its Directory of members is endorsed by the Law Society and has been since launch. The Directory can be searched by reference to location and the area of solicitors’ work in which the advisers specialise, notably trusts and estate, matrimonial, later life, and personal injury and Court of Protection.

The main benefit of working with a firm of financial advisers which is listed in the SIFA Professional Directory is that referring solicitors can be confident that their clients will receive advice which complements their own and will reflect well on their firm. The advice provided will be conflict-free, and many of the advisers will have qualifications and accreditations beyond those of the typical financial adviser, including the STEP Certificate for Financial Services (Trusts and Estate Planning), the Resolution accreditation for financial advisers, membership of the Society of Later Life Advisers, and Chartered status.

SIFA Professional also work closely with the Solicitors Regulation Authority to ensure their members understand how solicitors should compliantly and professionally work with third parties under the new Standards and Regulations 2019. They believe and hope that the silos within which professions have operated in the past are giving way to holistic advice provided by trusted advisers and desired by clients. It is their contention therefore, that solicitors who add financial advice to their menu of services, whether through referrals, joint ventures or as an ABS, will be better placed to face the competition arising from the Legal Services Act 2007, by reducing their current dependence on transactions and establishing the basis for enduring client relationships.