How does the small but perfectly formed legal practice manage its business?

A well-run law firm, big or small, knows how it stacks up against its peers. For those blissfully ignorant of their relative financial performance, the Law Society can provide valuable insight. All firms that take part in its annual Financial Benchmarking survey are provided with information about how they measure up to those of similar size and business area.

Once firms have acquired this valuable stepping-off point, it is essential that they create a profit improvement plan, says Mark Feeney of professional services consultancy Consergo. ‘Let’s say, for example, that you have a team of lawyers working in a sector and you benchmark their performance and find it substandard. The next step is to ask why. If they are a good team, why are they underperforming? Are the clients not as good? Or is the profit gap caused by poor financial management around time-keeping and billing?’

Feeney also believes that firms have to be ruthless when it comes to culling non-profitable business. He continues: ‘The starting point for many people who do my sort of work is to recommend that a firm drops the bottom 5-10% of clients each year. There are different ways of working out profitability of clients, both qualitative and quantitative. But if you speak to the lawyers, they will often know where they are losing money, be it publicly funded clients who won’t pay or delay paying on time, or a partner who interferes. Frequently, you will see that a client was charged £1,000 when the actual cost of the work to the firm was £3,000.’

Feeney says he is often called upon when firms are experiencing real difficulties. He acknowledges that it can be easier for him, as an outsider, to be forceful and tell firms which work they are going to turn away. But he is also optimistic about how quickly and dramatically firms can turn their finances around.

‘It depends on the extent of the problems. Some problems, of course, cannot be solved; if a firm has too much debt, or a historically bad professional indemnity record, or is paying too much for their premises. But if it’s solvable, firms can turn it around in six months. Even firms who don’t think of themselves as struggling can benefit from an increase in their underlying profitability if they slay a few “sacred cows” – by shutting offices, shedding [unprofitable] clients, or just doing things differently.’

One of the biggest sacred cows in the legal profession is that of billing terms. Many firms mistakenly believe that clients will up and leave if they change their payment terms. All of the experts consulted by the Gazette dismissed this. Indeed, Tony Roe’s experience should encourage firms to be brave and make their payment terms more conducive to the financial health of the practice.

He explains: ‘I didn’t have any negative reaction [to shortening terms]. I had a lot of support from clients, including those I brought with me. I think any business has got to think about all of its clients and if a law firm were to go out of business because one client didn’t pay, then all clients are affected. So yes, they were supportive.’

Firms are often surprised at the extent to which such simple measures can restore a firm’s finances. The consultants the Gazette spoke to have all seen firms wipe out their overdraft entirely after implementing modest changes to working practices.

Viv Williams of 360 Legal Group observes: ‘Everyone will accept interim billing. And why not call clients after seven days and remind them that their bill is overdue – and offer to take payment by debit card over the phone?

‘One of the things I am always talking about with banks is that, if only law firms could get their bills collected, then their lock-up would come down. In an ideal world it really should not be more than 90 days.’

According to a recent survey by accountants Crowe Clark Whitehill, one-third of law firms currently have lock-in exceeding 150 days. Williams knows of one firm which had a lock-in of three years for family law.

This is completely unacceptable, according to Williams, and the partner in charge simply had to go. He added: ‘Firms have to collect debts as quickly and effectively as possible.’

Another sacred cow worth slaying is that of support costs. Feeney has had clients who have outsourced their dictation, while others have taught fee-earners to type in a drive to boost profits. Moreover, he believes any small firm operating from multiple premises is spending money unnecessarily.

He said: ‘My general view is, don’t get locked into long leases or expensive borrowing. Try to stay as flexible as possible. Many firms who committed to properties in 2007 are coming unstuck.’

Check your structure

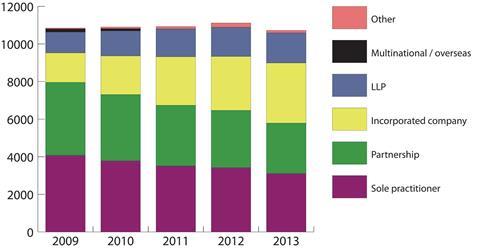

It is not just in respect of payment terms and property leases where legal consultants urge firms to rethink. Williams believes many small firms in particular could benefit from re-evaluating their very structure (see bar chart).

He explains: ‘It is not the tradionalist view, but I personally believe that the partnership is no longer fit for purpose in today’s world. We have to break those taboos of the past and we advise law firms to look at incorporation.

‘Most law firms will have capital account. If they convert [to limited company] the capital account can become a loan account and they can draw down from that to support the firm. Not only that, but the effective tax rate for the ‘partners’ becomes 10% instead of their personal [income] tax rate.’

Williams believes changing ownership structure alone could be more than enough to keep many small firms going over the next five years; by which time, one hopes, the market will have settled down and more benign economic conditions will prevail.

The changing face of practice

The number of law firms has dipped to its lowest level for many years, official figures show, which suggests that long-predicted consolidation has begun in earnest. There were 10,726 practising firms in England and Wales in September, a month-on-month fall of more than 200 and 400 fewer than a year earlier.

Traditional partnerships continue to decline, down 86 month on month to 2,681 and more than 1,000 on August 2009, when the SRA began keeping records.

By contrast, the number of incorporated companies has more than doubled in four years.

Get the right people

While it may be a cliche, people are the biggest ambassadors of any business. This is all the more so in a profession as heavily dependent on personal recommendations for new business as the law. Finding people who are the right fit for a firm is essential to its ongoing success.

Roe is not a fan of recruitment consultants when it comes to staffing his own firm. ‘Don’t get me wrong, I know some great recruitment consultants – but when it is your own practice you want to own it in every sense.’

Roe says he learned a lot about recruitment from the HR people at his previous firm and has drawn on that knowledge when hiring for his own practice. He continues: ‘Flexible working has worked very well for us and the staff who have taken it up. We seem to get 110% from them. So flexible working can and does work, but it is important to manage client expectations from the start. As a solicitor, you are advising clients and one of the things you advise them on is how you organise your time in the office.’

TEN HABITS OF HIGHLY EFFECTIVE FIRMS

- Consider the most appropriate business structure

- Invest in CPD for all employees

- Take time to find new staff who are the right fit

- Offer flexible working

- Issue interim and by return bills

- Have a lock-up of no more than 90 days

- Benchmark against peers

- Effectively manage out unprofitable clients on an annual basis

- Give careful thought to which business functions are done in-house and which are outsourced

- Have a clear, and well thought-out and executed, complaints-handing process

Invest in your staff

He adds: ‘We are a small firm and I think it is important to be fair and to be seen to be fair. I was one of the first 60 family law arbitrators to qualify in the country and my team were there to support me when I did that. So I thought it only fair that my staff got to do the courses they wanted to do as well. So in that same year, one trained as a mediator and the other joined Resolution. Yes, it was an expensive year, but clients now have an all-singing, all-dancing dispute resolution service.’

Roe went further with this ‘investment will pay for itself’ approach to the firm’s finances. He shares a bookkeeper with two other local firms. Even though the bookkeeper is self-employed, the three law firms paid to send her on a legal bookkeeping course to ensure their accounts were compliant with all SRA requirements.

The importance of keeping things in order and looking good from the regulatory perspective must not be understated. While it is still early days for outcomes-focused regulation, a quick look at the regulator’s most recent communications should be enough to convince any small firm of the merits of ensuring its accounting procedures are in good shape. For example, page 7 of the SRA’s most recent Risk Outlook, published last week, reveals a catalogue of financial mismanagement which in the regulator’s own view ranged from ‘naive to reckless’.

In short, ensuring those charged with managing firms finances are appropriately trained and conversant with SRA rules and expectations is essential to running a good small firm in 2013.

Complaints provide vital intelligence for your business

While the ability to demonstrate sound financial management is vital, is it by no means the only marker of a well-run firm acknowledged by the SRA and professional indemnity insurers. How a firm handles complaints is increasingly seen as a test of effective management too.

Barbara Spoor, of outsourced complaints handler PMACS and practice management specialist Esterase, spent nine years at the Law Society handling complaints before setting up her own business. She says: ‘A lot of firms don’t consider complaints a priority and put it on the back burner. They don’t take them seriously and just throw a bit of money at it. But you can learn a lot about your firm from a complaint.

‘Many complaints will be about costs, particularly in the current economic environment. But if a firm analyses those complaints, they could find that they have someone consistently not giving out the right information. By simply taking that person aside, for example, the firm will see its complaints go down.’

Spoor believes that once small firms take the time to consider how important word of mouth and reputation are to their business, they quickly grasp that complaints are a key business risk which need to be managed effectively.

She adds: ‘When it comes to renewing PII, what an insurer is looking at is not how many complaints a firm has received, but how those complaints have been resolved. That is true of the ombudsman as well. Firms have to think more about compliance.’

According to Spoor, one of the biggest triggers for complaints is where the client feels that fees have unexpectedly rocketed. She continues: ‘At the outset, a lot of solicitors will say “Mrs Smith has instructed me to get her divorce”. But good practice is to give her cost information and keep her up to date when that changes.

‘Nobody expects to go into Tesco and pick up an item which is marked £1.50 and then find that it costs £3.50 when you get to the till. We would complain and it is no different here. I advise firms to make sure they give a realistic cost estimate at the outset but also keep good cost records and update clients regularly as the work progresses.’

Outsourcing complaints-handling is one option. For example, it might take a £200-an-hour fee-earner eight hours to sort out a complaint, when they could be far more profitably employed on client work.

Embrace the media

While much of a small firm’s work will be generated by word-of-mouth referrals, there is certainly no harm in implementing an effective marketing plan. As long as firms do not bombard clients, there is nothing to be lost from communicating with them.

Roe has been writing articles for his local paper for many years and also tweets. He explains: ‘I like to do it. It’s not for everyone and I think it would show if we just made some sort of deliberate effort only to tweet on a Friday.

‘But I have now built it into my regular work. There is a whole new cadre of lawyer which has been delivered up by social media and I find things a lot quicker through Twitter than if I were to wait for published justice.’

Of course, not every small firm will have someone who instinctively embraces the media. But for those whom it does not come naturally, a plethora of organisations exist which can devise a plan to get you tweeting and commentating in no time at all.

Michelle McDonald is a freelance journalist

The Law Society’s Small Firms Division is committed to helping small firms and sole practitioners with advice, business tools and news, to help firms stay competitive. For more information see the website.

The Law Management Section is a specialist Section of the Law Society, providing members with the best available advice, information and support on the leadership and management issues of the day, enabling their businesses to perform better and more profitably. Membership benefits include four free webinars and four editions of Managing for success magazine a year, a regular e-newsletter, and discounts off other Law Society events and products. See the website.

2 Readers' comments