In a volatile world, private client lawyers are working harder than ever to provide stability and legal certainty for clients whose priorities have changed

The low down

The risks and restrictions that Covid-19 brought shook up the private client world, changing client priorities and requiring lawyers to modify their service and advice. And then Russia invaded Ukraine – spotlighting wealthy individuals with links to Russia and the lawyers who advise wealthy people and their families. The last few months have been uncomfortable for a sector renowned for its discretion and low profile. Yet there is more to private client work than the protection of wealth, and lawyers report a marked interest in arrangements that aim to protect the environment and avoid unethical investments. In this context, solicitors must adapt to thrive.

War and disease have rocked the business of private client lawyers and will continue to do so for years. Russia’s invasion of Ukraine in February coincided with the end of all Covid-19 restrictions in the UK, events emblematic of a period of turbulence for a sector unused to drama.

Russia and Ukraine

The private client practices of leading firms advise wealthy individuals and families on maintaining and building their wealth, succession and philanthropy – from drafting and executing wills and establishing trusts, to advice on taxation and the administration of estates. The Ukraine crisis has repercussions for this client group, with high-net-worth foreigners accounting for a large proportion of many practices’ work.

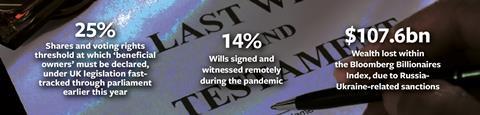

Most immediately affected are a select group of Russian clients. Sanctions imposed on Vladimir Putin’s co-national oligarch associates led to a combined loss for them of $107.6bn this year, according to Bloomberg Billionaires Index. (Though Russia still had 21 billionaires with a net worth of $254bn as of 14 March.)

The UK’s attraction to wealthy Russians and their money is well known. In its report into allegations of Russian interference in the 2016 Brexit referendum, parliament’s Intelligence and Security Committee described the capital as ‘Londongrad’.

According to the committee’s Russia Report, published in July 2020, ‘the key to London’s appeal was the exploitation of the UK’s investor visa scheme, introduced in 1994, followed by the promotion of a light and limited touch to regulation, with London’s strong capital and housing markets offering sound investment opportunities. The UK’s rule of law and judicial system were also seen as a draw’.

The British capital, it continued, ‘offered ideal mechanisms by which illicit finance could be recycled through what has been referred to as the London “laundromat”. The money was also invested in extending patronage and building influence across the British establishment – PR firms, charities, political interests, academia and cultural institutions were all willing beneficiaries of Russian money’.

The UK response to the invasion of Ukraine saw measures that had been on the backburner fast-tracked, with immediate ramifications for private client lawyers.

On 1 March, the government brought forward the Economic Crime (Transparency and Enforcement) Bill 2022 targeting anonymous overseas buyers of UK property. The legislation moved quickly through parliament and received royal assent on 15 March.

This requires overseas companies and individuals to declare the beneficial owners (those with more than 25% of shares or voting rights) of all property bought in England and Wales over the past 20 years and since 2014 in Scotland. Existing owners will have up to six months to register. The new legislation also expands and improves the Unexplained Wealth Orders regime, and strengthens sanctions powers.

In addition, the UK investor visa system was closed to all foreign applicants, not just Russians.

The Ukraine crisis may thus turn out to be at least as dramatic as Covid-19 for wealthy private clients and their lawyers. Large asset holders had a ‘good’ pandemic – the 10 wealthiest men more than doubled their fortunes during first two years of Covid, according to an Oxfam report published in January. But this new global shock could have the opposite effect.

‘The Covid-19 crisis and Putin’s war are totally different but what they have in common is the complete shock to what we thought was the norm,’ says Alison Broadberry, head of private client at London law firm Edwin Coe. ‘Catastrophic events focus all our minds on dealing with priorities, minimising risk and maximising added value to our clients, contacts, and internal and external communities.’ She adds: ‘We are all even more mindful that our purpose is much higher than just making a profit. We must seek to create positive change wherever we feel we can.’

‘Covid-19 has meant that we’re more used to working flexibly and managing new and unexpected situations,’ says Fiona Heald, partner at Hampshire-based Moore Barlow. ‘The new issue arising for us from the situation in Ukraine is that we need to review our matters to ensure we do not contravene the sanctions and act for anyone on the sanctions list, something that needs constant vigilance with everything changing on a daily basis.’ The UK has designated over 1,000 individuals and entities.

Business as usual

But Russian clients are not as big an area of focus as they used to be for many firms. Commenting on the potential impact of the war on profitability, Christopher Groves, partner in Withers’ UK private client and tax team, says: ‘Work with Russian clients is not a significant part of our practice. The big wave of [high-net-worth] Russians moving to the UK dried up some time ago and since then it hasn’t been a significant area of work for us.’

‘The Russian crisis has little impact,’ adds James Ward, partner and head of the private client department at Kingsley Napley. ‘No more than 1% of our client base is Russian and most of that is established UK-based Russians. Unless there is an increased threat of attacks in the UK then it is pretty much business as usual.’

In recent years firms have been looking elsewhere for growth. For instance, during the pandemic in May 2020, Mishcon de Reya opened a branch office in Singapore to serve high-net-worth clients across south-east Asia; and in November 2021 the firm entered into an association with Hong Kong’s Karas. ‘Both offices are an extension of our London office and highlight our commitment to clients from and with connections to Asia,’ says Stuart Adams, a partner in Mishcon Private, the firm’s international multidisciplinary practice.

Remote witnessing: A ‘knee-jerk’ response?

Solicitors voiced scepticism about the government’s decision to extend legislation on remote witnessing of wills until 31 January 2024. The measures were first introduced in July 2020 in response to Covid-19, and extended by a further two years.

A survey of more than 720 will practitioners published in December by the Law Society found that while most had drafted wills throughout the lockdowns, only a small proportion (14%) used video witnessing.

‘A six-month extension would have sufficed, given the very limited usage,’ says Stuart Adams, a partner in Mishcon Private and a member of the Law Society’s Private Client Section advisory committee. Adams drafted a lot of wills for clients during the pandemic and not one was witnessed remotely. Ditto for his colleagues. ‘It was always possible to arrange safe socially distanced signing ceremonies,’ he says, adding that ‘remote witnessing rules are complex and easy to get wrong and, accordingly, if they can be avoided, they should be’.

Fiona Heald, a partner at Moore Barlow and also a committee member, puts her finger on the problem: ‘Remote witnessing is very time consuming to manage and one challenge it poses is saying for certain who else might be in the room, off-screen. It is still easier to sign wills in person.’

‘In times of crisis government often turn out knee-jerk responses to perceived problems rather than seeking to address properly a more difficult underlying issue,’ says Withers partner Christopher Groves, pointing out this as an example. ‘The new rules also significantly weaken the procedures that are in place for the protection of vulnerable testators. Put simply, they are the wrong answer to the wrong question at the wrong time.’

For James Ward, head of the private client team at Kingsley Napley, the move reflects ‘the increased role “virtual” communication has necessarily and effectively played in engaging with all clients since March 2020’. But he argues that the wider issue, which predates the pandemic and which was the subject of a Law Commission report, is ‘how the formalities for an effective will, established in the Wills Act 1837, might be effectively revised in a more technological age’.

Ward concludes: ‘Perversely, with an ageing population of “baby boomers”, generally the wealthiest generation this country has ever known, more likely to lose mental capacity and be vulnerable to fraud, undue influence or financial abuse, the need for face-to-face interaction with solicitors and rigid formalities for wills in terms of form and execution may never have been greater.’

Covid-19 – changing aims

It is too soon to gauge the full repercussions of the war in Ukraine for private client lawyers who spoke to the Gazette in the early days of the conflict.

But in sharp contrast to the current political and media focus on controversial sources of wealth, Broadberry says: ‘I expect that we will see more HNW clients wanting to ensure their wealth is passed to “good causes” during their lifetime and after their demise.’

This continues a trend that accelerated after the coronavirus outbreak. Ward says: ‘The pandemic has focused minds on charitable giving. People are looking at making a difference closer to home and to local causes that might need the funds more urgently than large national organisations.’

Adams points out that HNW clients from developing countries ‘saw, more so than ever before, the extreme social divide. As a consequence, some want to bring about change and are prepared to invest their wealth in a variety of philanthropic and charitable initiatives’.

Gifts to charities are tax-free when left in a will and this increasingly combines with an observed global drive towards environmental, social and governance (ESG) investing.

‘We have seen an increase in requests from clients with philanthropic aspirations, often in relation to wider family governance advice,’ says London-based Robert Blower, partner and head of private client at Charles Russell Speechlys. ‘While the whole ESG and social impact area has seen growing activity for many years, the global challenges of the pandemic have clearly driven more individual, family and business sentiment towards responsible strategies, and responsible investing, with more investing for purpose to address inequality and environmental challenges.’

How have other areas of private client been affected by the pandemic? Ward pinpoints the ‘significantly larger number’ of wills and lasting powers of attorney (LPAs) completed by his team in the last two years. This trend continues.

‘Our family team has been extremely busy since the early days of the pandemic. The lockdowns clearly played a part in and were triggers for relationship breakdown,’ says Xavier Nicholas, partner and head of private client at Forsters. Meanwhile, he adds, estate planning ‘inevitably became a more pressing priority for some clients who had previously seen it as less urgent. Having more time to reflect meant ticking off items that had been lingering on the to-do list’.

Estate and succession planning means making preparations for where to bequeath money, not by just making a will but also setting up a trust, a tax-efficient investment portfolio, a family partnership or taking advantage of existing inheritance tax (IHT) exemptions.

Groves confirms that many clients found time in the pandemic to consider their estate and succession planning and put into effect arrangements that they had long thought about, but had never got round to completing. ‘For instance,’ Groves says, ‘many enacted wills or finally set up trusts after many years of considering one. Of course, one of the effects of the pandemic was to make people consider their health and their families, which no doubt inspired further planning.’ He adds: ‘We surveyed some of our clients in the spring of 2021, and found that their health and wellbeing, and that of their family, was a much bigger issue for them than business or investment performance.’

‘Clients are more focused on longer-term goals. Many clients have experienced a bereavement due to Covid, often family members who weren’t particularly frail or old and therefore unexpected,’ notes Gareth Marland, legal director in the private wealth department at Yorkshire firm Clarion and also a member of the Law Society’s Private Client Section advisory committee. ‘They have therefore been concentrating on succession and protecting wealth, as well as reducing their workload and seeking more time for pleasure and family. This has led to us holding more discussions about passing wealth on and seeing more referrals from financial advisers where clients are planning significant changes to their estate planning.’

Ward counters that during the pandemic period clients acted somewhat counterintuitively: ‘When markets went into freefall at the start of the pandemic, many resolved to hold on to what they had, despite the best time to make gifts [from the perspective of both IHT and Capital Gains Tax (CGT)] being when values are low. We saw many put their estate planning objectives on hold throughout 2020 and 2021 but have seen a noticeable increase in instructions this year – a sign of renewed confidence despite, perversely, the worst start to a new year for equity investments since 2008.’

Preserving and passing on wealth in a ‘tax-efficient’ way is the fulcrum of private client work. ‘The pandemic has increased pressure on government finances which has led to speculation around potential tax increases,’ says Blower, adding that as a result certain transactions have accelerated in the expectation that CGT will rise.

So how have private client practices performed financially during the pandemic? Many have expanded, increasing both revenues and profits, although not always as a direct consequence of Covid-19.

Adams says: ‘My team were increasingly busy over the last 18-plus months but that was the product of us continuing to build on an upward trajectory that predates the pandemic rather than Covid-related work.’

Pre-pandemic, he adds, ‘we were busy and growing. One of the key factors to our success was continuing to hire into the team notwithstanding the pandemic’. Adams argues that without those hires the firm would not have met the needs of clients as well as it did. ‘We continue to grow now,’ he says. ‘In the last two years we are nearly into double figures in terms of recruitment from NQs to partners.’ The bulk of that increase stems from private tax, including residence and domicile advice, wealth and succession planning for internationally mobile clients.

‘Our business has held up very well over the past couple of years,’ says Groves, pointing out that the latest financial year was ‘our strongest ever’ with total revenues growing 11% to £243.7m. Withers’ private client work accounts for the largest proportion of this.

The Covid-19 crisis and Putin’s war are totally different but what they have in common is the complete shock to what we thought was the norm

Alison Broadberry, Edwin Coe

The international firm’s UK team has expanded over the year through lateral hires including: residential property partner Pervaze Ahmed; art specialist Sarah Barker; tax and wealth planning partner Hannah Wailoo; and charity law partner Philip Reed. ‘There have been an even larger group of hires internationally, and we’re very much in growth mode,’ says Groves.

‘Covid-19 has certainly had a positive impact on the volume of work as people either worried about their own mortality or had time to look at their own affairs,’ says Ward. ‘I would say that conservatively we increased our billings by 20% in the full financial year from May 2020.’

That is only in part due to the hire of a partner and a newly qualified solicitor, Ward says: ‘Generally it was all about over 100% [staff] utilisation and fee-earners being more productive working from home and using Zoom.’

‘[Our] profits were higher than in the previous year or two, in part due to the same or higher revenues, but of course with lower costs due to so little travel, marketing or business development spend,’ notes Broadberry. But during the pandemic period the firm also hired two partners, an associate and a CILEX lawyer, among new recruits and promotions, to meet increased client demand.

Blower draws a direct link between Covid-19 and growth at Charles Russell Speechlys. ‘We have recruited a number of specialists to support the changing demands of our clients,’ he says. These include David Lingham and Simon Weil as a legal director and partner, respectively, within tax, trusts and succession. Weil, Blower notes, is ‘particularly well known for his work on philanthropy which is a significant focus’ for the firm.

More recent hires include Robert Reymond and his team as a tax specialist with over 20 years’ experience advising financial institutions and high-net-worth families in Canada, Latin America and Europe on international wealth structuring. Silvia On and Ian Devereux and their teams joined as private wealth specialists in the Hong Kong office. ‘These have all been areas of growth for the firm during the pandemic,’ says Blower.

The pandemic has had both a positive and negative lasting impact on the ways private client practices work.

‘How we conduct our business has changed and will never change back,’ says Ward. ‘Clients are very happy to do the majority of their meetings on Zoom or Teams rather than face to face. This has led to quicker turnaround and makes it easier to meet with both of a married couple.’

Building a rapport with clients is especially important for private client lawyers. ‘The shared experience of the pandemic has in some ways deepened our relationships with our clients,’ says Nicholas. ‘The lines between our working and personal lives have become more blurred, and many working relationships have in turn become more personal.’

Clients are more focused on longer-term goals. Many clients have experienced a bereavement due to Covid, often family members who weren’t particularly frail or old and therefore unexpected

Gareth Marland, Clarion

Lawyers are also working much more flexibly, meaning it is easier to be at the beck and call of clients. ‘The ability to work remotely has made it easier to adapt to changing expectations and habits in relation to business hours,’ Nicholas adds.

Firms’ reach has also expanded thanks to virtual meetings. Leeds-based Marland says: ‘The geographic spread of our clients has widened on matters. We have seen a marked increase in clients based in London, across the UK and internationally using our services.’

It has also added a new dimension in the recruitment process, Marland adds: ‘In some ways, recruiting and retaining talent is more challenging, but in others it is easier. People are no longer looking at working geographically close to home which opens up a broader talent pool for employers and more opportunities for jobseekers.’

There is another side to the talent coin, according to Nicholas: ‘The transition to hybrid working has put pressure on firms to differentiate themselves from their peers. Offering “something else” now weighs more importantly on the scales when competing to attract and retain talent.’

Clients have also become more demanding. Adams, who is a member of Mishcon’s Latin American team and advises HNW clients who are connected to ‘Lusophone’ (Portuguese speaking) countries, including Brazil, says: ‘If I need to speak to a client or contact in South America it has always required a flexible approach to office hours. However, during the pandemic I have found that clients have had a little more time on their hands and, as such, they have wanted access to their advisers on a more regular basis: early morning calls, late evening calls and [calls] over weekends have been common.’ While he does not much mind, Adams has to ensure ‘that boundaries are set for junior lawyers who need their free time to rest and recuperate and to enjoy life’.

‘Clients have come to expect faster responses,’ says Heald. ‘Many of the clients I act for are deemed mentally incapable so there was a challenge during the pandemic in obtaining mental capacity assessments to take matters to the Court of Protection, while care homes were closed to everyone.’

The new issue arising for us from the situation in Ukraine is that we need to review our matters to ensure we do not contravene the sanctions and act for anyone on the sanctions list

Fiona Heald, Moore Barlow

Increased digitisation

Covid-19 has accelerated other pre-existing trends. ‘We have noticed increased digitisation of government services during the pandemic, plus calls for future change,’ says Blower, referring to: the Ministry of Justice mandating in November 2020 the use of HMCTS’s online service for grants of probate applications by legal professionals, bar a few exceptions; the recommendations made in February by the Industry Working Group on the Electronic Execution of Documents (likely to drive further procedural and substantive legal change); and forthcoming LPA reforms.

It is a fine balance between ease of use through digital and online technology and protecting the most vulnerable, given that LPAs delegate a whole raft of life decisions – from finances to living arrangements – to a nominated person.

Commenting on the recent MoJ/Office of the Public Guardian (OPG) consultation on modernising LPAs, Heald argues that putting the entire LPA process online will not ‘safeguard the vulnerable from influence or abuse as there is no guaranteeing who might be influencing the person or filling out the form on their behalf’.

Heald concludes with a warning: ‘When LPAs were introduced, it was to ensure that perceived issues with Enduring Powers of Attorney were dealt with and people protected. It feels as though the OPG is undervaluing the power of LPAs by concentrating too much on making it easy to make one. It should not be ignored that, if someone does get access to a vulnerable person’s funds, that person could be left with nothing.’

Marialuisa Taddia is a freelance journalist

No comments yet