Greater choice is driving a more competitive PII renewal round. Eduardo Reyes reports from the latest Gazette roundtable discussion

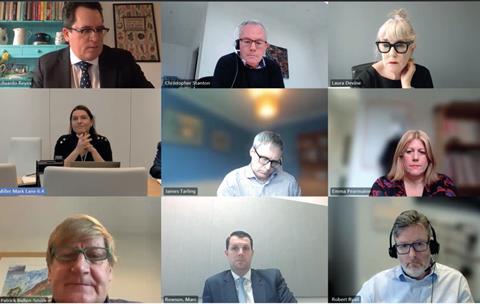

At the table

Top row (l-r): Eduardo Reyes Law Society Gazette, Christopher Stanton Keoghs, Laura Devine Laura Devine Immigration

Middle row (l-r): Zarina Lawley Miller, James Tarling Ashtons Legal, Emma Pearmaine Ridley & Hall

Bottom row (l-r): Patrick Bullen-Smith Hera Indemnity, Marc Rowson Lockton, Robert Ryall SA Law

Not pictured: Alain Orengo Weightmans, Linda Lee Weightmans, Simon Thomson Law Society, Sheona Wood DWF, Graham Reid RPC

Foundational economic orthodoxy, where supply and demand lines cross under conditions of perfect price elasticity in an open market, does not always present straightforwardly in the market for professional indemnity insurance. The time lag for claims and imperfect market information often contribute to a more complex picture.

But in 2024, market principles seem to be doing a better job. Brokers report a ‘softer’ market after several ‘hard’ years. ‘There’s certainly a more positive outlook than there has been for the last few years, which I think is great news for the profession,’ broker Lockton’s Marc Rowson says. ‘It’s positive both on the compulsory layer… but also in the excess layers. Fundamentally, that more positive outlook tends to be driven by more choice being available.’

‘The market is softer,’ confirms Hera Indemnity’s Patrick Bullen-Smith. ‘What’s interesting is that for the rest of the professions the market is even softer. The big thing is that new capacity coming in has led to insurers who currently write solicitors wanting to write more – wanting to write new business.’

‘There are more options,’ Zarina Lawley of Miller says. ‘In the one- to 10-partner space I think insurers’ criteria are probably a little bit stricter than maybe on 11-plus partner law firms,’ she notes, while offering a more positive view of conveyancing practices than insurers previously had. ‘For the first time, certainly in the last three years, these insurers have now got new business budgets to hit.’ The result, she says, is that insurers are asking brokers: ‘How can we grow?’

'We are being required to jump through more hoops to secure our premium finance. This has an impact on our business planning'

Emma Pearmaine, Ridley & Hall

How does this renewal round look from a managing director’s perspective? Yorkshire firm Ridley & Hall’s Emma Pearmaine sets out how it compares to previous years, using the percentage of fee income swallowed up by the firm’s premiums. This, she notes, ‘has gone from 1.8%, to 2%, to 2.9%, with this last year being the first that things are a little bit easier for us’. Increases in the cost of excess layer insurance rose three-fold in the same period, she adds.

In identifying a pool of insurers interested in her firm as a consumer practice, doing residential conveyancing limits choice, Pearmaine notes. ‘We were advised that there were no new insurers interested in us between 2019 to 2023,’ she says. An additional issue is ‘premium finance for the SME legal sector. We are being required to jump through more hoops to secure our premium finance’, she adds. This refers to finance facilities that can be used to spread the cost of PII premiums across the year, which has an ‘impact on our business planning’.

'The last renewal was a more competitive process… and we did see the softening in the market'

James Turling, Ashtons Legal

Robert Ryall, partner and joint head of disputes at St Albans firm SA Law, adds: ‘We appreciate we are a hostage to fortune in terms of capacity, but we’ve tried to personalise the process, and ensure that when we go through our renewal process we meet with our underwriter, we paint the picture that we want to paint, and we highlight those issues that underwriters are most concerned about, and we deal with them head-on.’

Has that worked? ‘I think,’ he says, ‘that combination – not looking at the process as a form-filling exercise, but actually engaging – has worked to our advantage historically, and hopefully will continue to do so.’

'The insurance has increased 12%. It’s one of our biggest expenses in the business. There’s little appetite for insuring a boutique firm'

Laura Devine, Laura Devine Immigration

At East Anglia firm Ashtons Legal, CEO James Tarling relates, ‘the last renewal was a more competitive process… and we did see the softening in the market’.

However, Laura Devine, managing partner of specialist City firm Laura Devine Immigration, offers a less upbeat take on the market: ‘Last year two insurers refused to even give us a quote. The insurance has increased 12%. It’s one of our biggest expenses in the business.’ She observes: ‘There’s little appetite for insuring a boutique firm.’

Insurer concerns

Christopher Stanton, a partner in professional risks at Keoghs who is attending for the Forum of Insurance Lawyers, says two Court of Appeal cases that centred on PII cover have caused concern for insurers. The first was Royal and Sun Alliance Insurance Limited & Ors v Tughans (a firm) [2023] EWCA Civ 999 (31 August 2023), which, among other points, held that the profession’s comprehensive cover was in the public interest. This trumped the insurer’s arguments on alleged ‘misrepresentation’ by the law firm.

The second and more significant case, Stanton notes, was Discovery Land Company LLC and others v Axis Specialty Europe SE [2024] EWCA Civ 7. The case centred on the ability of a solicitors’ insurer to decline cover for a claim on grounds of dishonesty and the meaning of ‘condonation’ of dishonesty. It also concerned the way the aggregation clause operates in a PII policy (the ability to aggregate multiple claims into one claim).

‘I think from an insurers’ perspective they are looking at a… trend [in] the Court of Appeal to very much narrow the ability of an insurer to aggregate multiple claims as one,’ Stanton says. ‘That obviously has a potential knock-on effect for the exposure of the insurers in the market.’

Time to look

It is a decade since the demise of a single renewal date of 1 October for PII. A common complaint before its abolition was that too many applications received too little attention, especially those of small and medium-sized firms. That meant that firms with a ‘good’ story to tell might not get full credit for it, and that less sound firms received too little scrutiny, thereby pushing up premiums.

How satisfactory is the process now? ‘An underwriter will always find the time to consider the risks that on the surface are attractive to them,’ Rowson says. ‘Time’s not necessarily a factor if underwriters want to consider underwriting a risk, and I think it’s how it’s presented that sometimes dictates that.’

‘I think being over 10 partners helps,’ Bullen-Smith says. ‘Your conveyancing threshold is much less relevant.’ In general, though, for smaller firms, ‘the change in the common renewal date… has really helped’.

‘Meet your insurer and build that relationship,’ Lawley urges. ‘If we look at October and April, the firms that got the most benefit from the softening market, it was the firms that met their insurers and had a long-term relationship with that insurer.’

The types of claim solicitors face determine insurers’ willingness to provide cover and at what level. A firm with higher-risk practice areas will have to work harder to present the case that it is well run and has taken steps to mitigate the risk of claims arising.

'We’re keeping a very close eye on the property market... where there is a decline in the property market it generally follows that there are claims that come through, particularly from lenders'

Alain Orengo, Weightmans

Professional regulation lawyers see those risks first-hand. Alain Orengo, consultant at Weightmans, London, sets the scene. Conveyancing is still the chief area of concern, he says, but adds: ‘In the context of wills, probate and trusts, we’re getting more claims where there have been issues arising from administration of estates (in particular).’

On conveyancing, Orengo says: ‘We’re keeping a very close eye on the property market at the moment, because traditionally where there is a decline it generally follows that claims that come through, particularly from lenders.

‘I certainly advise firms at the moment, from a practice management point of view, to look at the way in which they’re conducting conveyancing transactions, particularly with the need to impose training [and] supervision of staff.’

Lawley thinks lessons have been learned in conveyancing. Compared to previous downturns, she notes: ‘The criteria are so much stricter. The lending is much more responsible. Also, the way that law firms conduct the conveyancing has obviously changed from the last downturn.’

‘Sadly my in-tray is very full,’ DWF, London, partner Sheona Wood says. ‘We are still seeing a large volume of claims.’ She notes a growth in ‘identity fraud cases’, and speculates that this is driven in part by online and remote working that pandemic restrictions enforced.

‘I wonder… whether we’ve lost that sitting down at a table in front of a client to get to know the client,’ Wood notes. ‘There’s something to be said for that old-fashioned face-to-face meeting, talking to the client, just getting a feel for them.’

Other claims, Wood says, are centring on ‘fractional ownership of assets’; wills trusts and probate; mental capacity; failed litigation; and personal injury.

RPC partner Graham Reid says a driver for some claims was the long period of low interest rates, leading to ‘people chasing returns, piling into investment schemes’ with insufficient care. ‘We’re emerging from that low interest rate period, and my sense also is that time is starting to run out for pursuing these claims,’ he adds. ‘There just seem to be a lot of high-value cases kicking around out there. Cases that often have complicated coverage issues associated with them.’ In that context, the Discovery Land judgment alarms insurers all the more, he notes.

The impact of big claims on the market is not immediate, though, as Bullen-Smith notes. ‘It takes so long for them to be settled,’ whereas ‘insurers are thinking much more short-term capacity. They’ve got targets to hit, and they’re looking much more [at] individual risk.’

Still, Rowson notes: ‘A larger claim, particularly in the smaller firm space, can have a detrimental impact for the entirety of the profession. All it takes is one or two losses, and suddenly there are underwriters who will effectively say, “Right, we’re not now going to have any exposure to this area of work”.’

Building Safety Act

A lack of clarity created for conveyancing solicitors by the Building Safety Act, the legislative response to the Grenfell Tower tragedy, remains a concern for all. In particular, solicitors worry that they are being asked to sign off on what are, essentially, matters for surveyors. The roundtable meets a week after the Law Society issued guidance to support solicitors on conveyancing transactions for tall buildings caught by the act.

The guidance, Law Society policy adviser Simon Thomson says, ‘is designed to help our members decide whether or not they can make informed decisions about the Building Safety Act issues in relation to improvements to the legislation since it first came in in 2022.’

‘The guidance is definitely a start, and it’s interesting it’s the Law Society again and not the SRA giving this guidance,’ Wood says. ‘The whole Building Safety Act landscape is evolving… and it’s going to be subject to legislation in the future. It makes life very, very difficult for practitioners dealing with those risks.’

Compounding uncertainty in this area is the lack of BSA caselaw. Would litigation provide welcome clarity? ‘As long as it’s not one of my clients!’ Bullen-Smith replies. ‘Insurers have definitely got the Building Safety Act on their radar,’ he says, and are asking specific questions on it. As Lawley puts it: ‘From an insurance perspective, they’re not a fan.’

‘There’s a real inconsistency among insurers as to those that want more information on this and those that don’t,’ Rowson adds. ‘At the moment… there are still more questions around investment transactions on developments than there are on the Building Safety [Act].’

Instability

Linda Lee, a consultant at Weightmans and a former Law Society president, is keen to raise the impact of rising costs for law firms on their risk profile. ‘I have a sense that there’s instability in the market,’ she says. ‘Firms have faced increased employment and overhead cost but they’re also finding it difficult to attract suitably qualified people in certain areas. That includes support staff, for example in accounts. So that is going to have an impact.’

In addition, she says: ‘The SRA has reported a significant increase in the number of interventions, and although some are for fraud, they’re not all for fraud.’ The presence of ‘accumulator firms’ is an added source of instability, Lee adds. Such firms ‘are structured very differently to what we recognise as ordinary law firms’, she notes, ‘and the supervision is very different in those types of firms and control is also very different’.

Lawley adds: ‘From an insurance perspective, if you’re looking at firms that are accumulators or consultancy-based models, insurers [are] not a fan… [if] you’ve got somebody just sweeping up lots of firms – and they strip out all the assets and they’re all working from home… That kind of model makes insurers nervous.’ Supervision is a particular concern.

Rowson is critical of the SRA’s lack of initiative in interrogating the model of accumulator firms: ‘It was almost incumbent on the insurers that they were going to be the only ones [in a position to] put the brakes on.’

‘Regulatory risks are very high on the agenda for many firms,’ Reid says. That includes the SRA’s enhanced fining powers.

Looking forward, the profession, Lee notes, also faces a significant demographic risk. ‘When I qualified everybody wanted to be a partner in a firm,’ she says. ‘It was why you joined the profession. One of the reasons we’ve got firm closures now is that young solicitors do not want partnership, they don’t want it at all and they certainly don’t want it in smaller firms.’

This is a risk the SRA needs to take a lead on, she says. ‘That’s part of the SRA’s regulatory objectives – a strong, independent, diverse legal profession.’

- This roundtable was kindly sponsored by Hera Indemnity, Lockton and Miller

- For Law Society information and support on PII renewal, click here

No comments yet