Negligence claims are rising, but most firms are currently enjoying favourable indemnity premiums in what is a notoriously volatile insurance market. Maria Shahid finds out why – and how long such benign conditions are expected to last

New entrants to the professional indemnity insurance (PII) market, and a growing appetite from existing insurers, have given law firms a break from the relentless increases in premium rates seen in the early years of the decade.

While the picture varies by risk profile, feedback to the Gazette based on discussions with people involved in the market and a review of the major brokers’ reports suggest that most firms are seeing a reduction.

Large firms with high fee income have benefited the most, often seeing reductions of 5%-10% in their primary layer rates. Mid-sized firms have typically seen more modest decreases, around 2%-5%, depending on their risk profile and underwriting presentation. Smaller firms, particularly those with fee incomes below £500,000, faced a mixed picture. While some have benefited from the competitive market, others, especially those exposed to higher-risk areas, have experienced flat renewals or slight increases.

‘There’s plenty of capacity,’ says Paragon Brokers’ Dan Blundell. ‘New insurers have continued to enter the market, and new facilities have been set up by providers that are already in it. As brokers, we are being approached regularly by our partner insurers, and they are actively wanting to write new business, which is really positive.

‘Insurers are really keen to retain what they have, and we are also seeing simplified renewal processes or a simplified renewal form being provided,’ he adds. ‘The carrot for the client is a slightly discounted premium in some instances. So, it’s definitely a buyer’s market.’

Longer policy periods

John Wooldridge, executive director of Howden’s legal practices group, explains that policy periods longer than 12 months were a noticeable feature of April renewals: ‘From discussions with our clients, it was clear that the unexpected increase in employers’ national insurance contributions in April had unsettled many of them, so they took the opportunity to take out longer policies, as it locks in savings, provides financial stability and guarantees terms for a longer period, as well as reducing renewal administration.’

No post-Covid spike in claims

While insurers and PII lawyers predicted a wave of claims from the changes to work practices caused by the Covid-19 pandemic, these did not emerge, says Tom Bedford, a partner at Clyde & Co who acts on defendant professional indemnity matters.

‘During Covid, we were all thinking that we would need to brace ourselves for an explosion in claims, because we have got the perfect storm of people working from home without adequate supervision,’ Bedford says. ‘Legislative changes such as the stamp duty holiday meant that conveyancers were really up against it, and conveyancing is really the main area where claims arise. And yet, we have come out of that period, and we haven’t seen that explosion in claims. I think that has helped in making the sector more attractive to insurers.’

Claims are bigger

Brokers note that there has been an increase in the severity and complexity of claims, however. According to figures published by Lockton in April, 20% of claims are now pleading losses above £3m.

'Everything is a bit weird and wonderful at the moment, and we are seeing themes emerging. Claims by third parties is one of those themes, notably administrators and litigation funders'

Tom Bedford, Clyde & Co

‘Insurers are experiencing a double whammy at the moment,’ says Lockton’s Brian Boehmer. ‘Not only have some of the largest losses experienced by the legal profession of England and Wales crystallised in the last 12 months, but they are crystallising much quicker than they ever have. Some of these losses are from some time ago. So, while insurers will often request claims run [before renewal], and the minimum is usually six years and some like 10-year claims runs, insurers are intimating that they may have to require a 15-year-plus claims run to get a true reflection of the situation.’

Reasons for the quantum rise are manifold, says Bedford: ‘Everything is a bit weird and wonderful at the moment, and we are seeing themes emerging. Claims by third parties is one of those themes, [notably] administrators and litigation funders. Last year, we had the highest number of administrations since the 2008 financial crash, with administrators looking for the reasons behind those company failures. If that relates to legal advice, they will bring claims, which are often of a higher value.’

Renewal tips: Telling the right story

‘While PII premiums are improving, generally speaking, they are still within the top three expenses of a major law firm,’ says Paragon Brokers’ Dan Blundell. ‘So, it’s worth thinking about what you can do in addition to just the standard forms that insurers ask for. One thing we generally ask clients to do is to provide a covering letter alongside the proposal form, and we’ll give them a bespoke list of bullet points to touch on and create a covering letter.

‘I always see it as telling a story about a business,’ he adds. ‘So, how you got to where you are today. That’s what insurers want to know: how did this business get its, say, £5m turnover? How do they source the work? Is it local, is it word of mouth, or client recommendations? If it’s a very organic way of generating work, that gives the insurer comfort. That isn’t necessarily going to be asked in the proposal form, but if you say that you’ve been established for, say, 50 years in the local community and you’ve got a decent client referral rate, that really does help. It reassures the insurer that you’re not just taking every bit of work that you can. You are being selective.’

Blundell also advises firms to explain their onboarding process and clarify whether there are any types of work that they will not take on because they are seen as too risky. ‘This is why it’s important for brokers to meet their clients regularly, as you’ll learn a lot about the risk management a law firm has in place.’

Explaining the management and supervisory structure of a business is also crucial, together with the culture of the firm.

‘If insurers get the feeling that there is a “no-blame” culture, or an open-door policy, that gives them comfort,’ says Blundell. ‘Often, we find, in terms of claims trends, that certain problems could have been solved early in the transaction, but a junior lawyer doesn’t feel comfortable or confident to say they made a mistake, and then that problem gets worse. That’s where we start to see claims creep in.’

‘Make sure you’re properly supervising people,’ counsels Linda Lee, chair of the Law Society PII committee. ‘It’s about being vigilant and having proper processes to make sure you’re managing your business effectively.’

If there has been a claim, firms should use this as an opportunity to explain what they have learned from it, and what procedures have been put in place as a consequence, say brokers.

John Wooldridge, executive director of Howden’s legal practices group, notes that some clients that had received claims ‘had been able to convince insurers that the firm, as a risk, had improved’, and were therefore able to benefit from rate reductions because lessons were learned.

For information, guidance and tips from the Law Society, see its PII resources page

War chests

Litigation funding is also adding to insurers’ concerns. ‘Whereas in years gone by, settlements were brought at an earlier stage, because of the cost of litigation, now you’ve got some parties that are almost armed with a war chest, where they can take claims further,’ says Marc Rowson of Lockton. ‘So, I think that has been another factor in the size of claims that are out there.’

This is also a red flag from a risk perspective. ‘Litigation funding has increased and funders are in the business of making money. If there is a problem with a piece of litigation, then they naturally look to the solicitors involved,’ says Bedford.

There is also a growing trend of including breaches of regulatory duties in claims.

‘A breach of regulatory duty doesn’t give rise to a civil cause of action, but claimant solicitors and litigants in person are increasingly throwing those in to create leverage and are notifying the SRA,’ Bedford says. ‘Firms need to get ahead of that, so that if there is a problem, they report themselves promptly.’

Several insurers are now offering regulatory defence cover, as a useful way of differentiating their offer. As Blundell relates: ‘It can be added in to the PII policy, and while we are in a more benign market and insurers are trying to welcome new clients, it’s certainly something that, in my view, law firms should be asking their broker about.’

Residential conveyancing

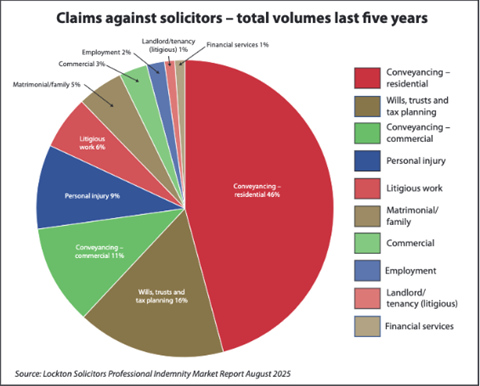

When it comes to practice areas most exposed to risk, data published by Lockton shows that the largest volume of claims continues to come from residential property work, followed by commercial conveyancing, and private client work.

As asset values have increased, so has the size of claims. One consequence of this has been an increase in probate litigation.

‘When I started in practice, probate litigation was rare. Now, you actually get firms that specialise in it,’ says Linda Lee, chair of the Law Society PII committee and a consultant at Weightmans.

‘You don’t have to be a billionaire… to have a very valuable estate,’ Bedford adds, ‘particularly if the estate comprises significant property.’

Excess cover

Under the SRA’s minimum terms and conditions (MTCs), sole practitioners and partnerships must carry £2m of cover, while incorporated firms are required to have £3m. While most claims fall within these limits, in certain practice areas, including conveyancing and private client, they can be higher, putting those firms that have an excess layer at an advantage.

Rowson notes that views will differ on this point: ‘Some firms will want to give themselves more protection, while other firms will assess the work they undertake, and will say we don’t need to buy more than the compulsory limit.’

‘In the past,’ Boehmer says, ‘the lack of competition increased rates, which probably disincentivised practices to explore this cover. However, with the emergence of fresh capacity, this may be the time to assess what is an appropriate level of cover, so that firms are suitably protected, given that the severity of claims has increased.’

'The slow uptake of cyber insurance policies by law firms means that many are left exposed to losses that could arise from circumstances, such as cyber theft'

Richard Atkinson, Law Society

Artificial intelligence and cyber risk

PwC’s 2024 Law Firms Survey reported that cybersecurity was the top concern for 90% of the UK’s top 100.

Cyber-attacks rose by 77% last year, largely due to the volume of sensitive information held by law firms, which hackers will routinely threaten to publish online.

The Solicitors Regulation Authority’s minimum terms and conditions (MTCs) cover third-party claims in the event of a cyber-attack, but do not cover any losses suffered by the firm itself, including incident response, data restoration, business interruption and ransom payments.

However, the uptake of cyber insurance to cover such losses remains low. The Law Society’s 2023 PII survey found that only 28% of firms purchased cyber policies.

‘Ransomware remains the most disruptive cyber threat to law firms,’ notes broker Howden’s July 2025 market report, adding that the ‘reputational damage and potential regulatory consequences of a breach further incentivise payment’.

Speaking to the Gazette, Law Society President Richard Atkinson says: ‘Cyber risk is an area of ongoing and increasing concern across the profession. The rise in email fraud, data breaches and ransomware attacks has led to increased scrutiny from insurers. We urge firms to strengthen their cybersecurity position by reviewing current protections, ensuring multi-factor authentication is in place and, where appropriate, considering standalone cyber insurance. This is particularly important given the express exclusion of first-party cyber losses from the MTCs for solicitors’ PII.’

Atkinson adds: ‘The slow uptake of cyber insurance policies by law firms means that many are left exposed to losses that could arise from circumstances, such as cyber theft from office accounts or data breaches, which can be very costly to remedy.’

When it comes to artificial intelligence use in law firms, insurers are taking an increasingly pragmatic stance. ‘There is an appreciation that AI could be complementary to the legal services offered,’ says Lockton’s Brian Boehmer. ‘The key is for the practice to be using it as a support function as opposed to the main function. Insurers are alive to the fact that it could be a really useful supporting tool, but that’s exactly what it should be: an aid. So, one of the things that insurers expect is that there should be appropriate communication about this within the firm, as well as an AI policy in place.’

Atkinson saays: ‘Firms using AI tools for document review, legal research or client work should have clear governance in place and carry out proper risk assessments to manage potential liabilities. All firms should discuss any AI use with their brokers.’

Metrics determine premiums

Insurers use rating metrics to determine a firm’s risk profile and its premiums. Blundell explains: ‘The three or four principal metrics are turnover, areas of work, staff numbers and claims performance.’

When a firm’s turnover increases, its premium may also increase, but the proportion of its turnover spent on the premium will decrease. This proportion is known as the ‘rate’.

‘So, a good result could still be that your rate on turnover reduces, but you still pay more premium,’ adds Blundell. ‘That’s an important distinction to make.’

Wooldridge says: ‘The majority of our clients enjoyed rate reductions (which can lead to lower premiums, although this depends on a number of factors), provided that they had not suffered any significant claims activity or large deterioration in claims experience.’

‘It’s not uncommon for premiums to go up on a year-on-year basis,’ says Boehmer. ‘But, if [a firm’s] turnover has gone up, the pennies in the pound going towards PII will have reduced, so on the whole it’s positive news.’

The practice areas that generate higher income are relevant too, he adds. Growth in lower-risk departments will have less of a knock-on effect on premiums.

Cost of excess ‘softening’

When it comes to excess cover, Boehmer notes that while in the past the cost has been a deterrent to some practices, Lockton has seen a ‘continuing softening in cost’.

‘With the emergence of fresh capacity, and increased competition, and with asset values and contract values increasing, it may be a good time to explore and assess what is an appropriate level of cover for practices, so that they are suitably protected,’ he adds.

Similarly, he advises that while there are advantages to staying with the same insurer to build up goodwill, it is equally important to evaluate the market, with a number of insurers providing ‘competitive solutions’.

Blundell stresses that staying in touch with a broker is important: ‘My recommendation to any law firm is that they should be seeing their broker ahead of renewals and then at least once outside of renewal, to either have a debrief about how the renewal went, or just general advice regarding how they can improve their risk profile.’

Short-lived spring tide?

This particular insurance market is cyclical, of course, so when will the market harden again?

‘What we brokers are seeing at the moment is that the claims environment hasn’t necessarily improved significantly, but there has been an increase in the supply in the market, which means it’s softer,’ says Blundell. ‘What law firms should be conscious of is that the market will eventually harden again. It’s not going to happen this year, but if rates continue to fall and the claims environment continues to be somewhat volatile, there will be more insurers who will make a decision to exit the solicitors PII market.’

‘Current market conditions are more akin to a short-lived spring tide,’ says Calum MacLean at Miller. Higher-value claims and the ‘increasing regulatory activity of the SRA and resultant defence costs’, along with other factors, will eventually lead to a ‘return to higher rates, and a much more difficult market’, he predicts.

For now, however, the downward movement in rates is likely to continue throughout the rest of 2025 and into 2026, and capacity will ‘remain in strong supply’, according to Wooldridge.

Using the opportunities the current market presents would be wise, say brokers. Boehmer concludes: ‘There are some longstanding insurers in this marketplace, who are providing competitive solutions. So, it’s really important that practices are exploring all the appropriate options while there is more capacity.’

Maria Shahid is a freelance journalist

No comments yet