Britain must lead the way on renewable energy, says chancellor Rachel Reeves. As Katharine Freeland reports, lawyers are helping to clear the obstacles standing in the way of net zero

The low down

Buried by Trump tariffs and off the White House carousel is news of the first investment for Great British Energy, a key Labour pledge at the 2024 election. With £8.5bn at its disposal, GB Energy’s first project will place rooftop solar panels on around 200 schools and 200 NHS sites using £200m of funding. Since coming to power, Labour has accelerated the race to net zero, bringing forward the Tories’ target by five years to 2030. Certainly, energy lawyers report that secretary of state approval for renewable projects that languished under the last government is now turned around at pace. However, opponents also use the law. Can investors rely on the government to stand its ground? Legal uncertainty is th

The UK is at a crossroads in its renewable energy policy. According to National Grid, 2023 was the UK’s cleanest year on record for energy generation, with 51% of the country’s electricity coming from zero-carbon sources – including 36% from wind, hydro and solar power – and less than 1% from coal. Yet in recent years the emphasis has shifted.

Before Russia invaded Ukraine in February 2022, the focus was firmly on growth and sustainability; finding new ways to develop clean energy sources that were better for the planet, and which supported the Paris Agreement target of limiting the temperature increase to 1.5C above pre-industrial levels.

Now the ‘energy trifecta’ is in the spotlight: security, affordability and sustainability.

'There is so much uncertainty for clients at the moment on many fronts. We are at a crucial stage for stakeholders in renewable energy projects'

Jubilee Easo, Eversheds Sutherland

‘The focus now,’ says Jubilee Easo, a partner in Eversheds Sutherland’s global energy group, ‘is how to create the perfect balance of all three – with security and affordability particularly important for consumers, developers and investors since the start of the Ukraine war. There is so much uncertainty for clients at the moment on many fronts. We are at a crucial stage for stakeholders in renewable energy projects.’

In recent years, energy prices have soared and inflation has hit, exposing the west’s reliance on Russia and other oil and gas-producing states. Renewables have not filled the fossil fuel gap. Moreover, the cooling of the so-called ‘special relationship’, coupled with the UK’s reliance on US liquefied natural gas (LNG) imports, has further exposed the UK’s energy vulnerability – although energy is one sector so far exempted from the tariff rhetoric.

Current blockers

From a regulatory perspective, two main obstacles are blocking UK renewable projects. These are National Grid connection reform and the prospect of zonal pricing.

Last December, the National Energy System Operator (NESO), operator of National Grid, announced that it was no longer viable to use the existing connections process to connect new power projects to the grid. NESO received over 1,700 applications in 2023/24, leaving more projects in the queue than are required for the energy system in 2030, or even 2050.

Instead of a ‘first-come, first-served’ approach, NESO decided that entry to the connections queue will be assessed on a ‘ready-first, connected-first’ basis. Those with existing grid connection offers and which have achieved ‘Gate 2’ – projects that have received outline planning consent from their local authority – will be prioritised for connection before 2027. A one-off application window will open for two weeks on 1 May for the existing queue, requiring developers to reapply for grid connection offers. The queue will then be reordered, removing ‘zombie’ projects.

There will be winners and losers. Some projects will be bumped and others handed an opportunity to move up the queue. Lawyers report that the connection reform is ‘a big deal’ for CEOs and GCs, creating turmoil for energy developers and investors.

Another headache is an ongoing consultation on zonal pricing under the Review of Electricity Market Arrangements (REMA) – a controversial model that would split the UK into regions with differing electricity costs based on local supply and demand dynamics. While those in favour argue that zonal pricing could reduce grid congestion and encourage investment in renewable energy in high-cost areas, the proposal has run into strong criticism. Sixteen businesses, trade associations and unions, including Unison, the GMB, UK Steel and Independent Renewable Energy Generators Group, have written to the government, warning that the scheme would unfairly penalise businesses and consumers in high-consumption areas, such as the south-east of England. A decision on zonal pricing is expected in the summer.

‘Zonal pricing could have huge impacts on the revenue streams of our investor clients,’ points out one energy lawyer. ‘There will be many contracting set-ups for projects that do not envisage this as a development. And investors do not like the uncertainty the consultation creates.’

Lawyers are making good use of the current pause in the renewable project pipeline to review existing contracts and consider how to future-proof new ones. They are also using the time to consider innovative funding models and contracting structures.

Osborne Clarke partner Matthew Lewis, the firm’s head of energy and energy transition, says: ‘We are engaging with government and regulators to feed into the design of new funding models for the long-duration energy storage sector, as well as nuclear, hydrogen and carbon capture technologies.

‘We know what works and what doesn’t from previous experience of energy projects across the breadth of the sector.’

An example of adaptation in action is the previous government’s decision to apply the Regulated Asset Base (RAB) funding mechanism to new nuclear power projects. The RAB is a young funding model that shares risk between investors and consumers. The device was previously used to fund the construction of the Thames Tideway Tunnel and Heathrow’s Terminal 5.

Power houses

- Dogger Bank Wind Farm: A sizeable offshore wind farm under construction off the coast of Yorkshire, with significant capacity to power millions of homes. According to National Grid, the average British home can be powered for two days by a single rotation of the blades of a turbine at Dogger Bank Wind Farm.

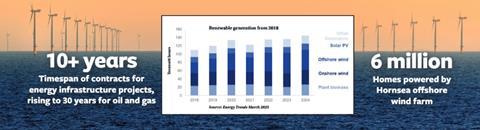

- Hornsea Offshore Wind Farm: The world’s largest offshore wind farm, located off the east coast of England. The zone currently generates enough power for over 6 million UK homes.

- Tees Biomass Station: A biomass station designed to generate sustainable power from wood pellets and chips, with a capacity to support 600,000 homes and save 1.2 million tonnes of carbon dioxide per year.

- Green Volt Floating Offshore Windfarm: A 400 MW floating offshore wind farm off the coast of Scotland. Europe’s first commercial-scale floating offshore wind project, it aims to reduce 1 million tonnes of CO₂ annually.

Top five battery storage projects from GlobalData

- The Sunnica Solar-plus-Battery Energy Storage System: a 500,000kW electro-chemical battery storage project which uses lithium-ion battery storage technology. The project will be commissioned in 2025.

- EFDA JET Fusion Flywheel Energy Storage System: a 400,000kW flywheel energy storage project with a rated storage capacity of 5,560kWh.

- Penso Power-Hams Hall Battery Energy Storage System: a 350,000kW lithium-ion battery energy storage project with a storage capacity of 1,750,000kWh.

- DP World London Gateway (pictured): a 320,000kW lithium-ion battery energy storage project with a rated storage capacity of 640,000kWh, due to be commissioned in 2025.

- Fortress Solar PV Park-Battery Energy Storage System: a 150,000kW lithium-ion battery energy storage project, commissioned in 2024.

Building blocks of a renewable energy project

Among the top 10 renewable projects in the UK pipeline is the Hornsea 4 offshore wind farm. The Hornsea Zone, which also contains projects 1, 2 and 3 (Hornsea 3 is under construction), is in the North Sea, 120km off the Norfolk coast and 160km off Yorkshire. Combined, the zone currently generates enough power for over 6 million UK homes.

Pinsent Masons has been advising Danish energy company Ørsted on the development of two of these projects – most recently on the Development Consent Order application for Hornsea 4 and the secretary of state’s decision.

‘The consent process is highly resource-intensive for clients, as you need a big team which comprises in-house and external legal, comms, property advisers, environmental consultants and engineers,’ Pinsent Masons’ legal director in infrastructure and planning, Claire Brodrick, relates. ‘There is a lot of upfront expenditure, without even knowing if the secretary of state will consent to the project. It is especially daunting for developers who are relatively new to the energy sector.’

With the rapid evolution in government energy policy and regulation, each project is a learning process. In the latest offshore wind and utility-scale solar projects, there is now greater collaboration between developers to get the projects over the line, says Brodrick, a lesson gleaned from the Hornsea developments.

Hornsea 3 was the first offshore wind farm to be consented under the regime for Nationally Significant Infrastructure Projects in reliance on a derogation case under the Habitats Regulations. This meant that the government granted permission so long as special ecological measures in the form of bespoke artificial nesting structures were put in place to preserve the kittiwake population – a gull species at high risk of extinction. This approach is now standard for most offshore wind projects.

'There is a lot of upfront expenditure, without even knowing if the secretary of state will consent to the project'

Claire Brodrick, Pinsent Masons

A similar development is the introduction of Biodiversity Net Gain (BNG), which means that habitats for wildlife such as hedgerows and trees must be left in a measurably better state than they were before the development. BNG kicked in during 2024 for developments under the Town and Country Planning Act and is expected to extend to nationally significant infrastructure projects by the end of 2025.

Consent is the first stage in the lifecycle of a renewables project. Planning and infrastructure lawyers work closely with property, regulatory, construction and finance colleagues, keeping an eye out for potential issues with investors, and being mindful of the needs of the next phases of implementation. The supply chain is important here, as some parts for wind farms can be hard to source. Indeed, the ability to forecast and account for myriad outcomes is a key skill when contract drafting.

‘Contracts for infrastructure projects are usually 10 years or more – and more than 30 in the case of some North Sea oil and gas projects,’ notes Clyde & Co partner Rebecca Armstrong, who operates at the other end of the infrastructure project lifecycle as a dispute resolution and international arbitration lawyer. ‘No one knows precisely how the regulations will change or where the next government’s emphasis will be placed in that time frame.’

A good energy team will have lawyers experienced at every stage of the lifecycle, who can extrapolate from previous projects – whether oil and gas, nuclear or green – and reassemble the institutional blocks of knowledge into a suitable configuration.

Eversheds’ Easo has worked for the energy sector for over 20 years, starting her career in oil and gas and diversifying into renewables, a trajectory reflected by many of her clients. Indeed, she heads Eversheds Sutherland’s international oil and gas practice, and its hydrogen practice.

‘In energy, cycles repeat themselves, like shoulder pads and bell bottoms. You have to know how to adapt,’ she says. ‘There is nothing that happens that is entirely new to energy lawyers.’

The maxim ‘necessity is the mother of invention’ is apt in the energy sector. Blockers loom from all angles – whether geopolitical, regulatory or supply chain-related – and present opportunities for creative lawyers.

‘The real sweet spot for energy lawyers is the intersection between projects where you can use your experience across the spectrum,’ says Osborne Clarke partner Hugo Lidbetter. ‘An AI-related data centre project, for example, powered by a private-wire solar farm where grid connections are constrained. Or it might be looking at how to make a solar and battery project work together through one grid connection. We are also working on evolutions that could answer the power demand and grid connection issue, such as using a micro or smart grid. Energy is not really a black letter law area, it’s about innovating using knowledge from multiple sources.’

What qualities are needed to succeed as an energy-focused legal adviser? ‘You cannot be a good energy lawyer without understanding the client’s business, how they make their money, what keeps them up at night – even the chemical composition of the products they use and where to source them,’ says Easo. ‘You have to be curious, ask questions, and have a strong interest in how politics works and world events.’

Achieving the trifecta

Net zero has multiple detractors and not everyone supports the clean energy transition, pointing to its cost and multiple flaws. Solar panels shipped from China are produced using coal-powered plants. Modern slavery concerns over the fabrication of parts are oft-cited. This week, that pressure led to the energy secretary agreeing to introduce an amendment to legislation to ensure there is no slavery in GB Energy’s supply chains. But the conundrums posed by geopolitical upheaval and the shifting sands of regulation have created work for lawyers – much of it creative, strategic and collaborative.

AI and advanced technologies are developing at pace, requiring data centres that consume massive amounts of energy just to send one meme around the world. How to meet this demand, whether through fossil fuels or clean energy stored long-term, are live questions. Achieving equilibrium in the energy trifecta – security, affordability, sustainability – affects us all, as consumers and professionals. As Easo points out, the widespread use of AI in business means that nearly every company now is a tech/energy company, whether they like it or not.

Lawyers who advise clients operating in the renewables sector, a diverse mix of investors, energy producers and suppliers, must weave together multiple strands – taking account of geopolitical outlook, governmental will, impact of proposed legislation and regulation, security of supply chains – and know their client’s business inside out. A talent for forecasting events over 10 years into the future when drafting infrastructure contracts is also handy. As for the much-mooted takeover of legal roles by technology, if AI reaches the point where it can replicate the multi-faceted skills of the energy lawyer, it will be doing very well indeed.

Katharine Freeland is a freelance journalist

No comments yet