A defendant fim has hailed the use of social media in securing a fundamental dishonesty ruling against a reality TV star.

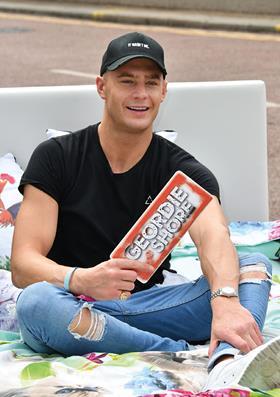

Scott Timlin, better known as ‘Scotty T’, who appeared in Geordie Shore and won Celebrity Big Brother in 2016, was ordered to pay an insurer’s costs following the collapse of his personal injury case.

According to a report from defendant firm HF, Timlin had been involved in an accident in Gateshead involving a customer of esure. The driver admitted liability but concerns were raised when Timlin made a PI claim 14 months after the accident.

He produced a medical report and issued proceedings in court claiming he had suffered soft tissue injuries to his neck, shoulders, lower back and right hand. He told his medical expert that the injuries were ongoing and severe 15 months later.

But an investigation by esure and HF found that Timlin continued to live a normal, active life. His Instagram account showed him on holiday in Ibiza one week after his accident, where he stayed for three months. Pictures showed him at parties and swimming. He never sought medical attention despite claiming severe pain.

Appearing in court to give evidence, Timlin claimed that the social media posts were old photographs that his agent would re-use to keep his profile active.

District Judge Thomas, sitting at Newcastle Upon Tyne County Court, found his case flawed and said it was a ‘mystery’ what treatment he had, what problems in his life were caused by his injuries and what the recovery period was. Under cross-examination, Timlin confirmed that he did not in fact sustain any lower back pain and his body and hand did not hit the interior of his car, discrediting his claim further.

Jared Mallinson, partner and head of counter fraud at HF, added: ‘This case is a fantastic example of our intelligence and fraud teams collaborating to help combat fraudulent claims for our clients. Social media played a huge part in Mr Timlin being found fundamentally dishonest and our holistic approach demonstrates the results that insurers can achieve.’

Timlin was found fundamentally dishonest and ordered to pay esure’s costs of £4,282.

This article is now closed for comment.

13 Readers' comments