‘Travelers’ merits about one citation a year in the Gazette, but perhaps deserves more. How so? Well, the US insurer has become an indispensable cog in the machine which is the UK’s £60bn legal ‘industry’. Travelers now provides PII to nearly 30% of all law firms in England and Wales – including a disproportionately high number of sole practitioners and mid-sized practices.

I’ve been around long enough to recall the panic that followed the collapse of Quinn over a decade ago. Quinn had 10% of the market. If Travelers went the same way, or even simply pulled out of the sector, the consequences could be startling.

I must add that there is no sign of either of these eventualities coming to pass. Travelers is the very picture of financial health, so far as I know. But it is a little unsettling that Travelers and Sompo International have nearly half the market by number of firms. That amounts to a lot of clout and demonstrates the diminution in options available to firms as the market has hardened.

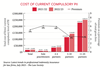

This statistic is just one juicy gobbet contained in the Law Society’s most extensive and detailed survey of PII trends since 2018, published last week. If you are in any way involved with procuring indemnity insurance for a legal practice, the survey is a must-read. I was spoiled for choice in pulling out headline numbers – the most arresting of which relates to the impact of this hardening on operating costs (and, at one remove, profit margins).

The cost of PII premiums as a percentage of turnover has almost doubled in five years, with this percentage higher among smaller firms and those which provide conveyancing services. Perhaps the spate of mergers we are seeing has less to do with entrepreneurialism, or the liberalisation of ownership, and more to do with the simple cost of insurance.

Elsewhere, one red flag is waving madly. The proportion of firms taking out cyber insurance, about one in four, has barely changed in six years, despite changes to the T&Cs excluding first-party losses resulting from a cyber event. ‘Firms should give serious consideration to buying a cyber insurance policy,’ the Society wisely counsels.

If they can find the money.

No comments yet