New Law Society research on PII trends is required reading for law firms that want to keep premiums in check. The market has eased, but small firms in particular still find the process difficult

At last, there is hard evidence of good news. Market stability and confidence are returning to the professional indemnity insurance market, following a three-year period in which the market hardened at a rate unseen for 20 years.

This softening does not necessarily mean premiums will fall, but most firms that do not offer high-risk services, such as conveyancing, are unlikely to see more than a single-digit percentage rise at their next renewal.

These are among headline findings of research published today by the Law Society on the latest PII trends for law firms. The research is based on a survey of 600 law firms and sole practitioners which renewed their PII between November 2022 and February 2023.

The findings explore: every stage of the PII process, from the average cost a firm is likely to pay to insure its business, to the time it takes for insurers to deal with proposals; the experiences of those who chose to use the same broker and insurer, compared with those who decide to switch; and trends in purchasing top-up, cyber insurance and run-off cover.

It does not come as a surprise to learn that in recent years capacity has reduced, competition has been limited, and premium rates and excesses have been rising. Insurers have also been taking a highly selective approach to the risks they choose to cover.

These factors have contributed to making the process of purchasing PII more difficult. Only 56% of firms found the process ‘very easy’ or ‘fairly easy’, down from 76% in 2018, with small firms of between two and four partners the most likely to report difficulties. Underwriters have required more information, and have also been less flexible on the ratios of work they are prepared to consider; less willing to take on the newly insured; and more willing to impose minimum premiums, higher excesses, and personal guarantees upon firm directors.

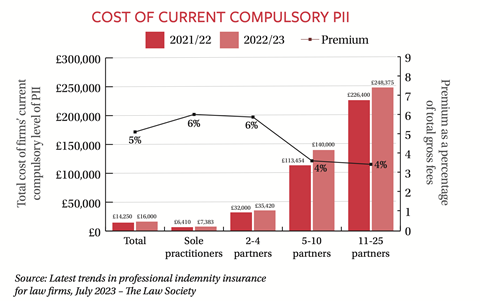

The median cost of PII cover is £16,000, with smaller firms seeing considerably larger premiums as a proportion of turnover. Sole practitioners are paying the equivalent of 6% of turnover on PII, compared with the 4% paid by firms with between five and 10 partners.

The median excess on claims is £5,000, with larger firms paying substantially more. It is possible, says the report, that firms are agreeing to higher excesses to reduce premiums or so an underwriter will agree to provide cover.

The average time between submitting a renewal proposal and receiving an offer is one month. Summer remains the busiest period for insurers, with about two in five (39%) firms starting their policies at the traditional renewal date in October. However, this has fallen from 64% of firms in 2018. PII renewals are now very much a year-round business, following the abolition of the mandatory renewal date in 2014.

Spreading renewals throughout the year should mean brokers and underwriters have more time to consider proposals. However, the Law Society’s report urges firms to start the renewal process early – at least two months before the renewal date, but preferably three.

Travelers remains the largest insurer, covering 28% of firms and almost doubling its market share since 2018. Sompo International, with 14% of the total market, is the most-used insurer by small firms (those with two to four partners). QBE (the preferred provider of the largest firms), Pen Underwriting and HDI rank joint third in the market with 6% each.

Shopping around remains unusual. Some four out of five respondents claimed to approach just one insurer for a quotation when renewing their PII cover, similar to 2017/18, and fewer are approaching two or three insurers.

The level of risk experienced among law firms is reported to have increased and is higher among larger firms. It is suggested that an increase in staff turnover, the number of fee-earners, and, predictably, the amount of conveyancing work could result in much higher premiums.

Although 20% of firms reported purchasing top-up cover, the indemnity limits have decreased since the previous policy period. Some 56% of the firms that purchased top-up cover have policies worth more than £3m above their primary layer cover, compared with 65% previously.

The research published today constitutes the most comprehensive insight into PII trends conducted by the Law Society for five years. Chancery Lane has urged solicitors to explore the full breakdown of results to ‘discover the steps you can take to keep your renewal costs down’.

The full 52-page appendix of data in the report is available to Law Society members with a My LS login.

Information about the Law Society’s courses on better management of PII can be found here.

6 Readers' comments