More than seven out of 10 law firms are still without cyber-insurance – despite rule changes in 2021 which expose them to potentially heavy losses if they suffer a cyber-attack.

That is one headline finding of a new Law Society report on trends in professional indemnity insurance, based on a survey of 600 law firms and sole practitioners that took out PII between November 2022 and February.

Though the PII market is said to be easing, the survey shows how the toughest market conditions for 20 years from 2020-2022 hiked operating costs at every size of firm.

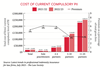

The median cost of compulsory cover rose most at firms with 5-10 partners, which endured a 23% rise to £140,000 in the last financial year. Sole practitioners saw a 15% rise. Since 2018, the cost of PII premiums as a percentage of turnover has almost doubled. Overall, the median cost of compulsory cover is up nearly a third on 2018 to £16,000.

Just two insurers now have over 40% of the market – Travelers with 28%, a doubling in market share since 2018, and Sompo with 14%.

The research also found that purchasing PII has become more difficult, while the level of risk for law firms has increased due to rises in the amount of conveyancing work and number of fee-earners. The proportion of firms renewing on the traditional date of 1 October has fallen from 64% to 39%, while the median excess on claims is £5,000, with large firms paying much more.

Society president Lubna Shuja commented: ‘Although stability is returning to the market, the process of buying PII has become harder. New firms entering the market and firms attempting to switch insurers have faced difficulties because of some underwriters imposing minimum prices for premiums. We advise firms to start budgeting for increased premiums and perhaps consider premium financing as a way to spread costs.’

Urging firms to consider buying cyber-insurance, Shuja added: ‘The latest government statistics show that one in 10 businesses – including a quarter of medium-sized businesses and almost two-fifths of large businesses – experienced cybercrime in the last 12 months. Considering how much more work is being conducted online post-pandemic, the low take-up is concerning.

‘Our research reveals that a third of firms (33%) have thought about purchasing cyber insurance, but did not go on to make a purchase. However, two in five firms (39%) have not even considered it, which is surprising, especially in light of recent regulatory changes.’

In 2021, the Solicitors Regulation Authority revised its minimum terms and conditions for PII to make it explicit that any first-party losses (those affecting the firm rather than clients) resulting from cyber attacks or other IT problems, were excluded from cover.

Law Society members can create a free My LS account to view the 52-page findings of the research in full.

This article is now closed for comment.

5 Readers' comments