It was the best of times, it was the worst of times. We already know that City firms boomed during the pandemic, as profitability soared while overheads plunged. Today the Law Society publishes compelling evidence that the best-managed practices in the small to mid-tier also thrived – boosted in part by fiscal breaks and furlough cash.

Now in its 21st year, the Law Society Law Management Section’s annual Financial Benchmarking Survey looks at how law firms fared in the crisis, providing an overview of performance in 2020-21. The average income of those surveyed was £5.3m.

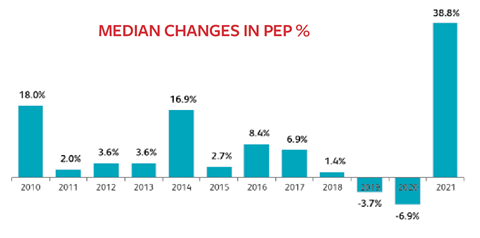

After two years of declining equity partner profits, median net profit per equity partner soared by 39%, from £146,417 in 2020 to £203,199. Adjusted to include a notional salary cost for equity partners, and also notional interest on partner capital, the median ‘super-profit’ for the year almost doubled to £102,097 (£52,775).

The surge was driven by a combination of:

- increased fee income, particularly in residential conveyancing (up 15.2%) and employment (up 12.1%);

- furlough grants and other grant income; and

- a reduction in employee and other overhead costs (light, heat, repairs and so on) as offices closed in lockdown.

Seven out of 10 participants reported year-on-year growth in fee income, with 40% seeing a rise of more than 10%. Median practice fee income increased by 6.2% (the largest rise for seven years), while median fee income per equity partner increased by 8.3%, from £761,981 in 2020 to £825,331.

The survey also delivers the first comprehensive insight into how the SME tier benefited from chancellor Rishi Sunak’s Covid mitigation measures.

More than eight out of 10 firms furloughed staff, claiming grants under the Coronavirus Job Retention Scheme. Furlough cash claimed in 2021 totalled £19m, an average of £92,000 per firm. One in 10 firms that claimed furlough money said they had either repaid the grants or intended to do so.

Most also took the opportunity to defer tax and national insurance payments, while 13% claimed local authority grants averaging £27,000 each. Three out of four firms borrowed money through the Bounce Back Loan Scheme or Coronavirus Business Interruption Loan Scheme, receiving a median £50,000 and £350,000 respectively.

Many firms have yet to deploy the loan monies, holding on to the cash ‘just in case’. Others used the loans to pay for professional indemnity insurance, taking advantage of lower interest rates than other PII funding options.

Despite their relative success, a key headache for all firms is recruitment and retention, with many pressured to increase pay by more than inflation. Firms are also redesigning remuneration packages, considering options such as staff bonuses, increased employer pension contributions, improved holiday and other benefits such as health cover.

‘Unless firms are able to increase their hourly chargeout rates and fees to clients in line with rising staff costs, we expect employment costs as a percentage of fee income to increase in next year’s survey,’ the report warns.

Law Society vice president Lubna Shuja commented: ‘Solicitor firms demonstrated their resilience through 2020-21, using lifelines from government to retain staff and equipping them to support clients from outside traditional office environments.

‘This survey highlights the range of vital activity, economic and social, which solicitors have continued to facilitate through the pandemic. It also provides insights into the drivers of success as firms look towards business in the new normal.’

LMS chair Paul Bennett said: ‘The pandemic posed huge challenges for law firms in terms of supporting clients through the most challenging period since the 1940s. Some did exceptionally well, others struggled – to some extent this was likely dependent on which sector or client group they supported. Those firms with good habits around client service, good practice that engendered trust at a critical moment in history and the ability to offer the right expertise for the moment did well.’

The LMS Financial Benchmarking Survey 2022 was compiled by accountancy firm Hazlewoods LLP and sponsored by Lloyds Bank Commercial Banking. It was based on questionnaires completed by 206 firms from across England and Wales with a combined income of £1.1bn.

A one-hour webinar on the survey findings will be held at 10 am next Friday, 29 April. For more details, click here.

No comments yet