The bar’s regulator suffered fresh embarrassment today on being told it must immediately improve its performance.

Tensions have been mounting between the Legal Services Board and Bar Standards Board (pictured above), after it emerged last month that 13 ‘key issues of concern’ had been raised by the oversight regulator.

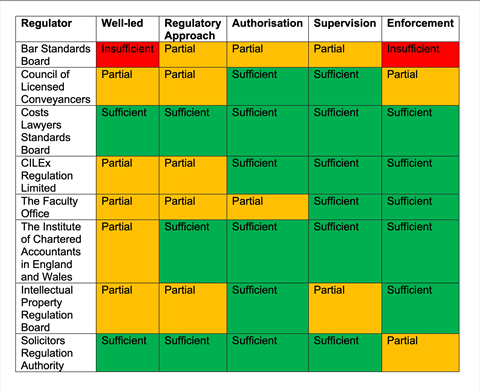

Now the LSB’s annual assessment of the eight legal services regulators has effectively failed the BSB on its leadership and enforcement strategy. It is the only regulator to receive red traffic-light ratings.

According to the assessment, underlying issues with the bar regulator ‘are not improving and in some areas are further deteriorating’. Problems with its enforcement activities were said to be ‘significant’ and ‘longstanding’.

The LSB assessment states: ‘The BSB must now fully engage with and accept the reasons for its underperformance and seize the opportunity to take ownership of the scale of concerns and the scope of improvement needed. We are hoping to see evidence of a determination to drive the step change in culture, capability and performance required for the BSB to become an effective regulator.’

The LSB has the statutory power to fine an underperforming regulator or even remove its leaders, although the Gazette understands these ‘nuclear options’ are not yet being considered.

The BSB’s own performance review last month reported that just 21% of cases are being referred for regulatory action within two weeks, against a target of 80%. The same target is in place for completing investigations within 25 weeks, but that has been met in just 38.7% of cases.

The LSB has also raised concerns with the bar regulator over its handling of complaints arising from the Post Office scandal, in particular the decision to pause the investigation into barristers implicated in the inquiry, which was made ‘without appropriate senior or board oversight’.

The LSB assessment adds: ‘Given that this is one of the most significant miscarriages of justice in recent times, with a significant potential impact on public trust, we would have expected the BSB to have ensured appropriate oversight of its decision and demonstrated a greater appetite to seek to progress its investigation in the public interest.’

Earlier this week, incoming bar chair Nicholas Vineall KC highlighted the BSB’s failure to meet performance targets in his inaugural speech. However he said he was ‘cautiously optimistic’ about progress under the BSB’s new chair, Kathryn Stone.

Meanwhile, the LSB’s verdict on the Solicitors Regulation Authority was far more positive, with the organisation meeting expected standards in every aspect apart from its enforcement activities, which received an amber rating.

The SRA was found to have failed to provide sufficient assurance about the quality of its handling of complaints about solicitors and how it is seeking to improve its performance in the area.

The LSB assessment adds: ‘During the year, concerns about the SRA’s complaints handling processes have been brought to our attention by members of the public and we are currently engaging with the SRA to determine the extent to which there are systemic problems with its complaints handling approach. As a primary purpose of regulation is consumer protection, we attach particular importance to the SRA’s performance in this area.’

The only regulator meeting required levels across all categories was the Costs Lawyer Standards Board. A recurring issue was found to be regulators’ transparency about decision-making.

Chris Nichols, director of policy and regulation at the LSB, said: ‘We expect regulators to operate transparently and ensure they have a sufficiently robust evidence base for their work. This is central to being a well-led organisation and ensures others, including the public, can understand how decisions are made and hold the regulator to account. For a number of regulators there is more work to do in this regard.

‘Over the coming year, we will roll out our new framework for assessing regulators’ performance. We will follow up on the themes and issues identified in this assessment and expect all the regulators to continue working on improving their performance.’

This article is now closed for comment.

14 Readers' comments