Commercial property lawyers are negotiating a divided market, amid changing work patterns, ‘green’ considerations and legislative change. Maria Shahid reports

The low down

Widespread uncertainty over the contents of last November’s budget led to a decline in commercial property investment. For property lawyers, that lull has been replaced with growing optimism. Viewed from abroad, the UK remains a secure and stable prospect. But the expertise clients seek is focused on deals involving existing buildings – already grade A office space, or scheduled for retrofitting. Increasingly, legal advisers are dealing with top-end environmentally focused leases whose requirements are moving from ‘light’ to ‘dark’ green. Here, clients are willing to move in advance of government. Yet as lease reforms loom, there is concern that ministers are prepared to junk the idea that the contract is ‘sacrosanct’.

The UK commercial property market exhibited some nervousness in the run-up to chancellor Rachel Reeves’ November budget. There was reduced investment activity in the preceding months. But optimism is slowly returning to the market, say lawyers.

‘There is definitely a lot more positivity this year than I think there was last year,’ says Jason Tann, partner at London firm Howard Kennedy. ‘There was a bit of a sigh of relief after the November budget and there is now quite a clear trajectory for interest rates to come down. Current geopolitics are also encouraging investment into the UK, which is seen as a relatively safe haven.’

Imran Essa, partner at Essex and London firm Rainer Hughes Solicitors, agrees: ‘Overall activity levels are steady, with the start of 2026 bringing a degree of unexpected optimism.’

Global real estate consultancy Knight Frank’s post-budget analysis noted that ‘the fundamentals of UK commercial real estate remain strong’, and ‘the UK is still firmly on the radar of international investors and remains the top destination for global CRE capital’.

‘This could be a rare point in the market,’ Rebecca Foord, director at international firm Fieldfisher, suggests. ‘As valuations have adjusted, interest rates have stabilised, new supply is dropping across sectors and demand drivers are evolving.’

'Demand significantly outstrips supply on grade A space, while clients in the secondary market are having to think outside the box to try and make their product attractive to tenants'

Jason Tann, Howard Kennedy

While demand for office space remains generally strong in the capital, a two-tier market means demand is location-dependent. Low levels of development activity have kept rental yields high, but these too can vary according to location, say analysts.

‘The return-to-office [trend] and escalating construction costs have dampened new office developments [but] increased the demand for existing spaces, causing rents to rise,’ says Lauren Perdikis of HCR Law’s Cardiff office. She predicts that, alongside rising rents, regulatory and compliance obligations have a part to play, with one of the most affected sectors being mixed-use developments.

‘Demand significantly outstrips supply on grade A space, while clients in the secondary market are having to think outside the box to try and make their product attractive to tenants,’ adds Tann. ‘If you have grade A space, you will have a long queue at the door – there is so much demand for it. Mainly this is because post-Covid, there just wasn’t enough new office space coming forward.’

Chris Waddingham, head of commercial property at Yorkshire firm Ison Harrison, says that for landlords, the choice this year is either to commit to a ‘deep retrofit’ or to repurposing.

Investor appetite has also shifted towards comprehensively refurbished offices over new developments, accounting for about 70% of acquired space. ‘Investment is returning,’ notes Foord, ‘but only for buildings that can prove they are future-proof, sustainable, modern and ready for hybrid work.’

Occupier demand is also playing an important role in the ‘flight to quality’. Cara Imbrailo, partner at Charles Russell Speechlys, London, explains: ‘The office is recognised as a genuine retention tool. So, if you can’t offer an office environment that’s worth commuting for, as a company, you’ll be at a competitive disadvantage.’

Health and wellbeing now sit at the heart of office design. ‘With younger generations set to make up 80% of the workforce in advanced economies by 2034, tenants expect workplaces that actively support mental and physical health,’ says Foord. Features such as natural lighting, ergonomic furniture, wellness rooms, biophilic design and outdoor access have rapidly become standard requirements.

Race to zero

Last month, the government confirmed in the Warm Homes Plan that from 1 October 2030 it will not be possible to let a residential property in the private rented sector without an Energy Performance Certificate (EPC) with a rating of C or above, unless there is a valid exemption.

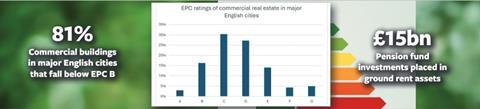

The EPC rating for commercial property has not yet been similarly tightened. Figures released by the British Property Federation (BPF) this week found that 81% of commercial buildings in major English cities fall below EPC B. A 2021 government consultation on minimum energy efficiency standards (MEES) sought views on a target of EPC C by 2027 and B by 2030. In a statement issued by the BPF, assistant director Rob Wall noted: ‘The Warm Homes Plan has left commercial landlords in the dark and out in the cold. We have been waiting for five years for a decision on future [MEES] for the non-domestic private rented sector. It is beyond belief that ministers have kicked the can down the road once again.’

In the meantime, the market is setting its own, higher targets. ‘The direction of travel on EPC regulation is clear, even if the milestones remain uncertain,’ says Waddingham. ‘Whether or not EPC B becomes compulsory by 2030, lenders and institutional tenants are already behaving as if it has.’

Imbrailo adds: ‘The expectation among my clients is clear; they know that tighter standards are coming, even though they may not know exactly when, and they are preparing accordingly.’

Says Waddingham: ‘Corporate occupiers are taking a harder line than ever on operational performance. EPC ratings, resilience of plant and verified building safety documentation now sit alongside rent and location when they shortlist buildings. Occupiers are increasingly unwilling to carry the regulatory risk that comes with inefficient stock.’

Green lease clauses are becoming more demanding, with ‘dark green’ clauses increasingly popular. This is driven not just by landlords and lenders, but also by tenants seeking assurances that buildings meet their ESG commitments.

‘Green lease clauses are now entirely standard in every lease,’ says Imbrailo. ‘There was a first generation of green clauses, which were on the lighter green side, but as they have become more commonplace, over the last few years, with the latest version of the Green Lease Toolkit, published by the Better Buildings Partnership, we have seen further advances and tweaking to sustainability obligations.’

Data sharing is a key focus in such clauses, she adds. Older light green clauses only required data to be reported. More recently, there has been a move to sophisticated, almost granular requirements, along with provisions which allow landlords to install automated meter systems to enable consumption data to be gathered directly from providers. This ‘direct data access can transform sustainability from an aspiration to a reality’, Imbrailo notes.

Retail therapy

The retail sector continued to struggle in 2025, hit by rising national insurance contributions, employment costs and the upcoming business rates revaluation in April. Relief for retail, hospitality and leisure, initially set at 75% during Covid, has also been cut to 40%.

While a new lower business rates multiplier for qualifying retail, hospitality and leisure properties was announced in the autumn budget, with a rateable value below £500,000, properties with a rateable value of over £500,000 now have a higher multiplier, which comes into effect from April 2026.

This higher multiplier will apply to larger high street retailers and large distribution warehouses, including those owned by online retailers.

‘The new business rates multiplier in the 2025 budget could provide a vital boost to the high street,’ says Lauren Perdikis of HCR Law. ‘However, it’s crucial to acknowledge that this relief is not uniformly distributed. Larger stores, with rateable values exceeding £500,000, will face elevated rates, potentially dampening resilience in the market.’

‘Business rates remain a significant pressure point for occupiers, particularly in secondary office and retail premises,’ adds Ison Harrison’s Chris Waddingham. In the meantime, his firm is advising clients to examine rates liabilities at the heads of terms stage rather than treat them as a ‘fixed overhead’.

Leasehold reform ‘jitters’

The government unveiled significant leasehold reforms at the end of January in the draft Commonhold and Leasehold Reform Bill. These included capping ground rent at £250 per year, moving to a ‘peppercorn’ (effectively zero) rent after 40 years, as well as proposals to make it easier for existing leaseholders to transition to commonhold.

Freeholder groups have voiced concern that the changes would compromise existing property contracts, while investors fear it could harm savers and other companies that have invested in UK assets. Pension funds like ground rent investment because it is a secure income stream. The Residential Freehold Association, a trade body for freeholders and investors, estimates that pension funds have invested more than £15bn in ground rent assets.

In a statement by M&G in response to the draft bill, the asset manager said that it is currently exposed to £722m of ground rent assets through its Prudential Assurance Company shareholder fund, adding that while it supports the government’s objective to strengthen leasehold protection, ‘the proposed solution is disproportionate, and we will continue to consider our response’.

The BPF, in a statement by director of policy Danny Pinder, said: ‘While we agree that rapidly escalating ground rents should be addressed, the proposed cap will interfere with investments made by pension funds and institutional investors over many years and undermine the government’s pursuit of investment in this country.

‘There are billions of pounds invested in large-scale residential and mixed-use developments, and it is essential that reform is mindful of the rights of property owners as well as leaseholders.’

'Legislative changes that cut across and undermine existing commercial agreements will raise the risk premium that investors attach to the UK'

Danny Pinder, British Property Federation

Successive governments have attempted to deal with the ‘ground rent scandal’. This first came to the fore in the mid-2010s, with the rise of new-build sales as leasehold rather than freehold, with some lease clauses doubling ground rent every 10 to 15 years.

Tann at Howard Kennedy says that ‘this is a bit of a sledgehammer to crack that issue. There are other, more creative ways to address it, such as removing the mechanism for increasing [ground rents], rather than removing them altogether’.

A far bigger problem, say critics of the latest draft provisions, is the government’s appetite for using legislation to interfere in property rights.

‘In our legal system, contract is sacrosanct,’ says BPF’s Pinder. ‘Legislative changes that cut across and undermine existing commercial agreements will raise the risk premium that investors attach to the UK at a time when the government is seeking to attract domestic and private capital for its growth agenda.’

‘The legislation effectively rewrites contracts where investors purchased portfolios at a value based on the ground rent returns, which are proposed to be reduced and then outlawed,’ notes Richard Robinson, partner at Hägen Wolf. ‘This will surely affect investor confidence in the property industry, where you do not know whether what you agreed one day will be effective another day.’

These latest proposals follow ‘hot on the heels’ of the ban on upwards-only rent review announced last year, notes Tann. ‘The big story with this latest change [in leasehold] is that it’s retrospective. The government is actually rewriting contractual arrangements between landlords and tenants, and that will potentially have an impact on investor confidence in the UK. The problem is that a lot of what this government does has unintended consequences for the letting market generally.’

Draft provisions to ban upwards-only rent reviews in commercial leases were introduced last year, as part of the English Devolution and Community Empowerment Bill, which is currently at the committee stage in the House of Lords.

Tann explains that the intention was for the ban to apply in relation to the high street; however, it has ‘unintended consequences’ for the letting market generally. ‘So, for example with City office lettings, where the government really does not have a place legislating in arrangements between landlords and tenants. There is no policy reason to do that.’

He adds: ‘It may be that in the process of the legislation making its way through parliament a narrower set of restrictions emerges. The devil will be in the detail, and there will be other ways of structuring leases where clients want long leases, a five-year rent review and they still want a certain income.’

Rent reviews traditionally use a hypothetical lease, which takes the open market rent as the starting point. However, the tenant appetite for shorter lease terms may mean that the standard rent review cycle is no longer relevant and lessen the impact of any potential ban on upwards-only rent reviews, notes Imbrailo.

She explains: ‘Many landlords have moved to a standard index-linked review basis, which offers a certain element of certainty to both parties. It certainly makes rent reviews quicker and easier to agree, with parties not having to instruct surveyors to debate open market rents.’

Way ahead

As 2026 progresses, green refurbishments are likely to outweigh new developments, with hybrid working and return-to-office mandates shaping the future of work.

While it will not alter the core of what commercial property lawyers do, it will alter the value they add, Waddingham concludes: ‘In 2026, clients want speed, certainty and commercially grounded risk management. That means tackling EPC uplift, safety governance and rates exposure in the first conversation, not the last. If anything, the market is pushing us to operate as strategic partners rather than pure legal technicians.’

Maria Shahid is a freelance journalist

No comments yet