One of the ‘greater minds and finer characters’

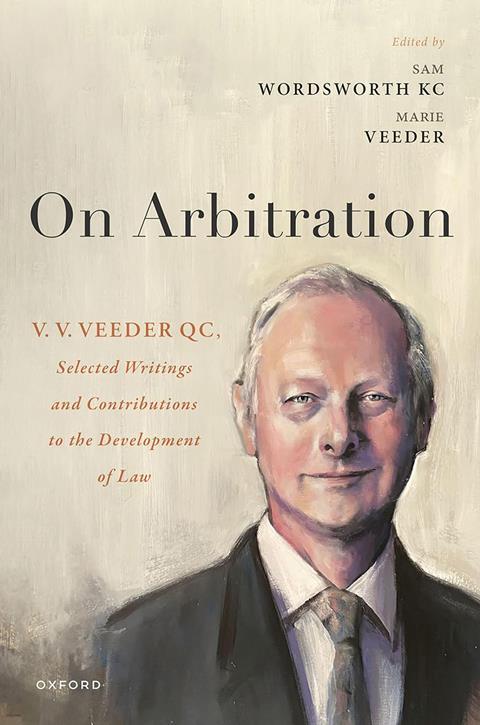

On Arbitration: VV Veeder QC, selected writings and contributions to the development of law

Sam Wordsworth KC and Marie Veeder

£150, Oxford University Press

★★★★★

Van Vechten Veeder (universally known as Johnny) was a towering figure in the world of international commercial arbitration and in investment treaty arbitration. He was frequently described as a ‘giant of arbitration’. This book is a collection of his essays and includes extracts from certain key arbitral awards where he was the presiding arbitrator.

Johnny sadly died on 8 March 2020. He studied at Clifton College, Bristol, and Jesus College, Cambridge. He was called to the bar in 1971. He began practice at 4 Essex Court, taking silk in 1986. Johnny then began and developed a practice far beyond England. He increasingly focused on international disputes. Over a period of 45 years, he travelled the world fighting and sometimes deciding arbitration cases. He was one of the world’s most sought-after arbitration practitioners, practising both as an advocate and an arbitrator.

In a lengthy introduction to this book, Stephen Schwebel, a former judge and president of the International Court of Justice, writes that Johnny was ‘towering, literally’ in the worlds of international commercial arbitration, and arbitration between state and foreign investors, because Johnny was taller than most!

This book is divided into three parts: learning from the past; the international arbitration process; and key questions for all users of international arbitration.

As readers may be aware, there has been an explosion of international investment arbitration in recent years. A network of bilateral investment treaties (BITS), combined with the activities of the International Centre for the Settlement of Investment Disputes (ICSID) in Washington DC, have been the key building blocks to the resolution of disputes between states and foreign investors. However, is the system actually working given the lack of a streamlined enforcement mechanism?

ICSID is a part of the International Bank for Reconstruction and Development (the World Bank). The purposes of the World Bank are to assist in the reconstruction and development of the territories of the member states; to promote international trade and the maintenance of equilibrium in balance of payments; to raise standards of living; and to improve conditions of labour. In recent years, the World Bank has adopted a governance agenda and imposed conditionality on states in order to encourage, inter alia, transparency, anti-corruption measures, the reform of legal systems, the reduction of poverty and the promotion of sustainable development.

ICSID’s aim is to promote international development. It is designed to encourage private international investment through the establishment of a favourable investment climate; acting as a stimulus to private foreign investors, particularly in developing countries. The investor has direct access to an effective international arbitration forum in the event that a dispute arises, while their state is able to attract more international investment by signing and ratifying the ICSID Convention. An effective system for the settlement of disputes is beneficial both for investors and host nations. However, the lack of an effective enforcement mechanism means that, unfortunately, the system is not working as envisaged by its founders.

Traditionally, a foreign investor’s complaints were referred to the investor’s home state. The process of diplomatic espousal was undertaken, but only if the investor’s state was prepared to take up the claim. ICSID arbitrations were supposed to ‘depoliticise’ investment disputes, obviating the need for the investor’s state to become involved. No thought was given at the time the ICSID Convention was drafted to the issue of compliance with, and enforcement of, awards rendered against states in international investment arbitration. Indeed, it was asserted that enforcement issues against states were ‘unlikely to arise’ given states’ obligations under the ICSID Convention and their reputational motivations.

Unfortunately, instances of non-compliance with investment arbitration awards predominate. Argentina tops the table as the most frequently sued state, with Venezuela coming a close second. Russia has been involved in 26 arbitrations in recent years. Russia has generally not complied with adverse awards. Most recently, in January 2024, investors in oil and gas company Yukos seized land at 245 Warwick Road in Kensington, London, belonging to the Russian Federation, in an effort to enforce an arbitration award amounting to $50bn that was handed down in the Netherlands in 2014. Yukos was seized by the Kremlin in 2003 after Mikhail Khodorkovsky (the company’s former boss) fell out with Vladimir Putin. Khodorkovsky was later jailed for alleged tax evasion and fraud. Arbitration proceedings were issued and the current outstanding debt is now $60bn with interest.

Poland is the third most-sued state under intra–EU BITs. Investors have initiated 31 arbitrations against Poland. Investors have brought 24 arbitrations against Kazakhstan. While Kazakhstan has complied with some of the adverse awards issued against it, other awards have been challenged or not complied with, or only complied with after a substantial delay and strenuous efforts on the part of the successful party.

Non-compliance with arbitration awards raises concerns about the effectiveness of the investment protection regime. Johnny writes about the Lena Goldfields arbitration against the Soviet Union in 1930, which ensued only because of the UK espousing the UK investors’ claim. The claimant was an English company and it took several decades for the UK investors to obtain compensation. This case remains a sobering example of how a state may effectively thwart the international arbitration process.

While the present system is flawed, it is preferable to claims being subject to the willingness of an investor’s state to espouse their claim, as was previously the case. Improvements to the system are necessary – and no doubt Johnny would have agreed with that. In addition to enforcement of awards, there are other procedural difficulties when arbitrating, including the impartiality of arbitrators.

For example, Johnny writes about the Loewen arbitration, which was a dispute between two Canadian investors and the US. The investors complained that they had been treated unlawfully by the state courts of Mississippi. The corporate investor had been held liable by the local jury for $500m which included $400m as punitive damages. The investor was unable to appeal because the local law required the posting of a fund equal to 125% of the judgment, an obviously impossible burden for a small foreign company facing bankruptcy.

After the arbitration, the American arbitrator in the Loewen case took part in an academic symposium in New York where he spoke about the case. Johnny quotes Professor Jan Paulsson: ‘The symposium happened to be recorded, and the tenor of his remarks was notably made public in the law review in 2009. This included the revelation that the arbitrator had met with officials of the US Department of Justice prior to accepting the appointment, and that they had told him: “You know, judge, if we lose this case we could lose NAFTA [North American Free Trade Agreement]”. He remembered his answer as having been: “Well, if you want to put pressure on me, then that does it”.’

It is also rather odd that the ICSID Convention does not actually define the term ‘investment’. Thus, tribunals are faced with the challenge of whether there is a ‘qualifying investment’ before they can determine whether the tribunal has jurisdiction.

Chapter 11 comprises Johnny’s Goff lecture (the Lawyer’s Duty to Arbitrate in Good Faith). The lecture provides guidance for anyone who wishes to work in this field.

Johnny’s work is central to international arbitration because of his clarity of thinking and his methodology. He was able to simplify extremely complex legal situations.

Toby Landau KC stated in a tribute on behalf of Essex Court Chambers: ‘Every step of [Johnny’s] remarkable career was infused not only with an extraordinary intellect and inspiration, but also a sense of the greater good. He was principled to the core, and genuinely concerned that the right thing was always done. As an arbitrator, however flawed the dispute might have been, he had a talent for bridging differences, after leaving the hearing room with everyone feeling good about themselves and each other.’

Johnny’s writing also shows his warmth and wit. As Judge Schwebel states at the conclusion of his introduction: ‘To know Johnny was to know one of the greater minds and finer characters of our time.’

Stephen D Sutton is principal of Suttons Solicitors and International Lawyers, London W1

No comments yet