Most small and medium-sized solicitor firms enjoyed another bullish trading year in 2021/2022, though their performance was not quite as stellar as in the previous 12 months.

This is the key conclusion to draw from the Law Society’s 22nd annual benchmarking survey, published by the Leadership and Management Section and produced by accountants Hazlewoods. Some 155 mainly SME firms with average income of £7.1m took part, making the survey one of the largest of its type in England and Wales. Fewer than 30 participants were in the £10m-£35m turnover band.

The research was carried out between July and October 2022, when society was recovering from the pandemic. Most participants have either a 31 March or 30 April accounting date.

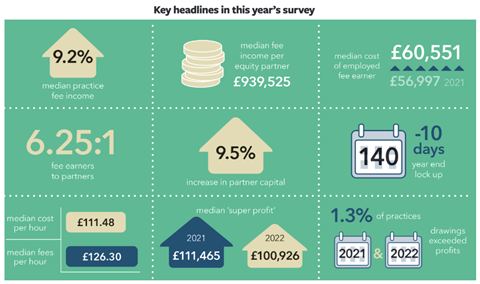

Overall, 75% of participants reported year-on-year growth in fee income in 2022, with 46% seeing growth of more than 10%. Median practice fee income increased by 9.2%, while median fee income per equity partner increased by 5.4% from £891,693 in 2021 to £939,525 in 2022. Average fees per fee-earner were £138,925, compared to £130,533 in 2021 – a rise of 6.4%.

Most work specialisms reported a median increase in fee income – across all regions – with residential and commercial property posting rises of 17% and 12% respectively. Most conveyancing firms have exploited the buoyant market by increasing their fee rates several times in the last couple of years and have not reduced them since.

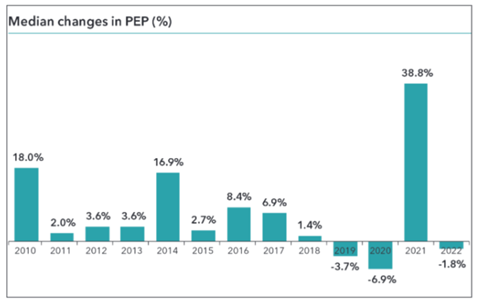

And what of profits? Context is all important. Last year’s survey showed a median increase in profit per equity partner of almost 40% – boosted in part by fiscal breaks, furlough cash, a red-hot housing market and a slump in overheads as staff stayed at home. That was the best result since at least the financial crash of 2008/09 and for many firms, PEP was the highest it had ever been.

Viewed in that light, a 1.8% decline in median net profit per equity partner in 2021/22 – from £203,577 to £199,846 – remains a highly impressive result (see bar chart). The amount of furlough money claimed by participants fell from £20m in 2021 to just £750,000.

Lubna Shuja, president, the Law Society

"It is encouraging to see law firms continuing to perform strongly, especially given the difficult economic climate we are all facing. As the cost-of-living crisis hits England and Wales, the legal sector will continue to be an important driver of the UK’s economy.

It is good to see firms focusing on helping staff deal with the crisis and increasing salaries to retain and recruit staff.

Of course, some firms struggle more than others, with lack of government investment continuing to hit legal aid firms. In this current crisis, lawyers are needed more than ever to help people access justice in their time of need. The government must take action to stop the shortfall in legal aid providers before it is too late."

Similarly, in 2021, the median ‘super-profit’ for the year almost doubled, when adjusted to include a notional salary cost for equity partners, and also notional interest on partner capital. So a fall in that number in 2021/22 – from £111,465 to £100,926 – demonstrates that for most firms, profits remained well above pre-Covid levels.

In improving conditions, the ratio of fee-earners to equity partners tends to increase as firms grow, with the opposite happening in a downturn. Back in 2009, when Hazlewoods took over the survey, the median gearing ratio was 4:1. Since then a steady rise in fee income saw the gearing ratio gradually creep up to 6:1 immediately before the pandemic. Another rise is recorded in this year’s survey, to 6.25:1.

Is this a high point to which law firms may struggle to aspire in coming years? Quite possibly. In the last six to 12 months, as the research acknowledges, they have entered much choppier waters. Soaring inflation, higher bank base rates, record energy prices and high wage growth are all bearing down on profits. Professional indemnity insurance costs have also rocketed, with rises of between 10% and 30% for primary cover and even higher increases for top-up cover.

A key challenge too is recruitment and retention amid a cost-of-living crisis, with firms under greater pressure to increase salaries. Some firms brought forward pay reviews to address this.

Very few firms have so far elected to make one-off cost-of-living payments, however. They have focused instead on overall remuneration packages, including options such as staff bonuses, higher employer pension contributions, improved holiday entitlements and the introduction of other benefits such as health cover.

Paul Bennett, chair, Law Society Leadership and Management Section

"In tough economic times, the resilience of law firms shines through, although we need to remember these findings pre-date the cost-of-living crisis, the UK’s political contortions of 2022 in terms of multiple prime ministers and, of course, the impact of the war in Ukraine. The results reflect the property boom of 2021 and the challenges in the service economy during the 2021/2022 financial year. Resilience is, though, a good sign, knowing as we do that firms are currently steering through the ongoing choppy waters.

Firms reviewing this year’s survey might like to consider the growth in fee income, the 10-day reduction in lockup and the median equity capital trends. These three give a great insight into fee income, collection, and capital needs: all of which will be useful to help plan ahead."

Employment costs rose as a percentage of fee income in 2022. The report forecasts another increase in next year’s survey unless firms are able to increase their hourly chargeout rates and fees to clients in order to compensate.

So how much did fee-earners actually cost last year? Full-time equivalent numbers excluding equity partners rose 3.2% on 2021, to 7,342. The median cost of a single fee-earner rose by 5.8% to £53,341, rising in line with firm size. The median spend on support staff, meanwhile, fell from 17% to 15.8% of fee income.

As the market slows, how can law firms ease pressure on profit margins? They need to focus on generating more fees from fee-earners – and not just by increasing chargeout rates, the report recommends.

The benchmarking survey’s most intriguing finding is that working from home may damage productivity after all. A general rule of thumb is that fee-earners should be charging at least 1,000 or 1,100 hours a year. But this year the median number of chargeable hours actually fell, from 863 in 2021 to 841. This ‘supports the growing evidence that working from home is not always as beneficial to the firm as it is to the individual’, the report concludes. No wonder ‘more and more firms are calling their staff back to the office for at least some of the week’.

‘Sweat your people assets’ would seem to be SME firms’ main priority.

- Read the full survey report free here. Firms who would like to register their interest to participate in the 2023/24 survey can contact benchmarking@hazlewoods.co.uk. The Financial Benchmarking Survey 2023 is written and produced by the legal team of Hazlewoods LLP for the Law Society Leadership and Management Section and sponsored by Lloyds Bank Commercial Banking.

No comments yet